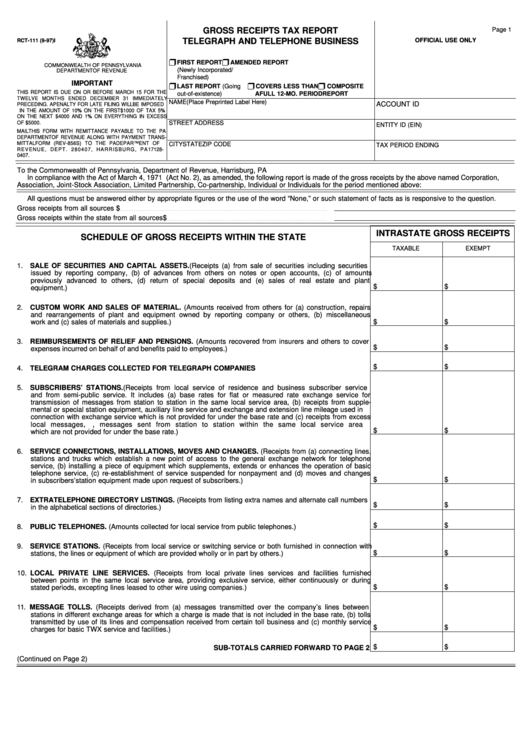

GROSS RECEIPTS TAX REPORT

Page 1

TELEGRAPH AND TELEPHONE BUSINESS

OFFICIAL USE ONLY

RCT-111 (9-97) I

FIRST REPORT

AMENDED REPORT

COMMONWEALTH OF PENNSYLVANIA

(Newly Incorporated/

DEPARTMENT OF REVENUE

Franchised)

IMPORTANT

LAST REPORT (Going

COVERS LESS THAN

COMPOSITE

THIS REPORT IS DUE ON OR BEFORE MARCH 15 FOR THE

out-of-existence)

A FULL 12-MO. PERIOD

REPORT

TWELVE MONTHS ENDED DECEMBER 31 IMMEDIATELY

NAME

(Place Preprinted Label Here)

ACCOUNT ID

PRECEDING. A PENALTY FOR LATE FILING WILL BE IMPOSED

IN THE AMOUNT OF 10% ON THE FIRST $1000 OF TAX 5%

ON THE NEXT $4000 AND 1% ON EVERYTHING IN EXCESS

OF $5000.

STREET ADDRESS

ENTITY ID (EIN)

MAIL THIS FORM WITH REMITTANCE PAYABLE TO THE PA

DEPARTMENT OF REVENUE ALONG WITH PAYMENT TRANS-

MITTAL FORM (REV-856S) TO THE PA DEPARTMENT OF

CITY

STATE

ZIP CODE

TAX PERIOD ENDING

R E V E N U E , D E P T. 2 8 0 4 0 7 , H A R R I S B U R G , PA 17128-

0407.

To the Commonwealth of Pennsylvania, Department of Revenue, Harrisburg, PA

In compliance with the Act of March 4, 1971 P.L. 6 (Act No. 2), as amended, the following report is made of the gross receipts by the above named Corporation,

Association, Joint-Stock Association, Limited Partnership, Co-partnership, Individual or Individuals for the period mentioned above:

All questions must be answered either by appropriate figures or the use of the word “None,” or such statement of facts as is responsive to the question.

Gross receipts from all sources

$

Gross receipts within the state from all sources

$

INTRASTATE GROSS RECEIPTS

SCHEDULE OF GROSS RECEIPTS WITHIN THE STATE

TAXABLE

EXEMPT

1. SALE OF SECURITIES AND CAPITAL ASSETS. (Receipts (a) from sale of securities including securities

issued by reporting company, (b) of advances from others on notes or open accounts, (c) of amounts

previously advanced to others, (d) return of special deposits and (e) sales of real estate and plant

$

$

equipment.) .........................................................................................................................................................

2. CUSTOM WORK AND SALES OF MATERIAL. (Amounts received from others for (a) construction, repairs

and rearrangements of plant and equipment owned by reporting company or others, (b) miscellaneous

$

$

work and (c) sales of materials and supplies.).....................................................................................................

3. REIMBURSEMENTS OF RELIEF AND PENSIONS. (Amounts recovered from insurers and others to cover

$

$

expenses incurred on behalf of and benefits paid to employees.) .........................................................................

$

$

4. TELEGRAM CHARGES COLLECTED FOR TELEGRAPH COMPANIES ........................................................

5. SUBSCRIBERS’ STATIONS. (Receipts from local service of residence and business subscriber service

and from semi-public service. It includes (a) base rates for flat or measured rate exchange service for

transmission of messages from station to station in the same local service area, (b) receipts from supple-

mental or special station equipment, auxiliary line service and exchange and extension line mileage used in

connection with exchange service which is not provided for under the base rate and (c) receipts from excess

local messages, i.e., messages sent from station to station within the same local service area

$

$

which are not provided for under the base rate.) .................................................................................................

6. SERVICE CONNECTIONS, INSTALLATIONS, MOVES AND CHANGES. (Receipts from (a) connecting lines,

stations and trucks which establish a new point of access to the general exchange network for telephone

service, (b) installing a piece of equipment which supplements, extends or enhances the operation of basic

telephone service, (c) re-establishment of service suspended for nonpayment and (d) moves and changes

$

$

in subscribers’ station equipment made upon request of subscribers.) ...............................................................

7. EXTRA TELEPHONE DIRECTORY LISTINGS. (Receipts from listing extra names and alternate call numbers

$

$

in the alphabetical sections of directories.)..........................................................................................................

$

$

8. PUBLIC TELEPHONES. (Amounts collected for local service from public telephones.) ...................................

9. SERVICE STATIONS. (Receipts from local service or switching service or both furnished in connection with

$

$

stations, the lines or equipment of which are provided wholly or in part by others.)............................................

10. LOCAL PRIVATE LINE SERVICES. (Receipts from local private lines services and facilities furnished

between points in the same local service area, providing exclusive service, either continuously or during

$

$

stated periods, excepting lines leased to other wire using companies.) .............................................................

11. MESSAGE TOLLS. (Receipts derived from (a) messages transmitted over the company’s lines between

stations in different exchange areas for which a charge is made that is not included in the base rate, (b) tolls

transmitted by use of its lines and compensation received from certain toll business and (c) monthly service

$

$

charges for basic TWX service and facilities.) .....................................................................................................

$

$

SUB-TOTALS CARRIED FORWARD TO PAGE 2

(Continued on Page 2)

1

1 2

2 3

3 4

4