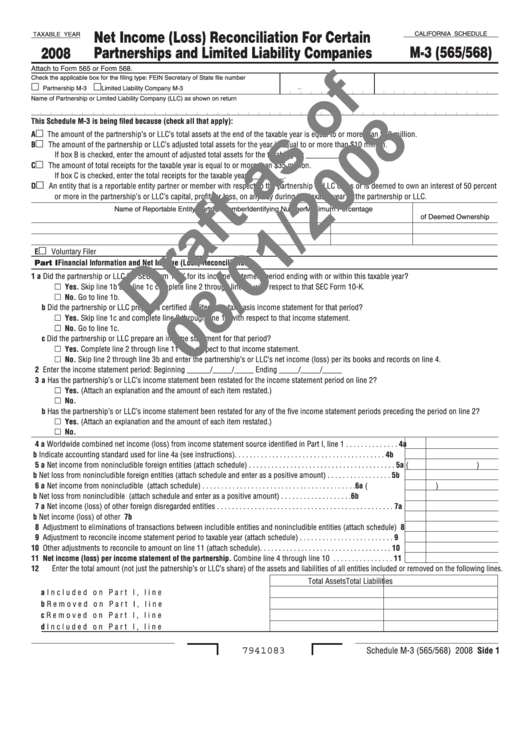

California Schedule M-3 (565/568) Draft - Net Income (Loss) Reconciliation For Certain Partnerships And Limited Liability Companies - 2008

ADVERTISEMENT

Net Income (Loss) Reconciliation For Certain

CALIFORNIA SCHEDULE

TAXABLE YEAR

M-3 (565/568)

Partnerships and Limited Liability Companies

2008

Attach to Form 565 or Form 568.

Check the applicable box for the filing type:

FEIN

Secretary of State file number

-

m

m

Partnership M-3

Limited Liability Company M-3

Name of Partnership or Limited Liability Company (LLC) as shown on return

This Schedule M-3 is being filed because (check all that apply):

m

A

The amount of the partnership’s or LLC’s total assets at the end of the taxable year is equal to or more than $10 million.

m

B

The amount of the partnership or LLC’s adjusted total assets for the year is equal to or more than $10 million.

If box B is checked, enter the amount of adjusted total assets for the taxable year _________.

m

C

The amount of total receipts for the taxable year is equal to or more than $35 million.

If box C is checked, enter the total receipts for the taxable year _________.

m

D

An entity that is a reportable entity partner or member with respect to the partnership or LLC owns or is deemed to own an interest of 50 percent

or more in the partnership’s or LLC’s capital, profit, or loss, on any day during the taxable year of the partnership or LLC.

Name of Reportable Entity Partner/Member

Identifying Number

Maximum Percentage

of Deemed Ownership

m

E

Voluntary Filer

Part I Financial Information and Net Income (Loss) Reconciliation

a

Did the partnership or LLC file SEC Form 10-K for its income statement period ending with or within this taxable year?

m Yes. Skip line 1b and line 1c complete line 2 through line 11 with respect to that SEC Form 10-K.

m No. Go to line 1b.

b

Did the partnership or LLC prepare a certified audited non-tax basis income statement for that period?

m Yes. Skip line 1c and complete line 2 through line 11 with respect to that income statement.

m No. Go to line 1c.

c

Did the partnership or LLC prepare an income statement for that period?

m Yes. Complete line 2 through line 11 with respect to that income statement.

m No. Skip line 2 through line 3b and enter the partnership’s or LLC’s net income (loss) per its books and records on line 4.

2

Enter the income statement period: Beginning ______/_____/_____ Ending _____/_____/_____

3 a

Has the partnership’s or LLC’s income statement been restated for the income statement period on line 2?

m Yes. (Attach an explanation and the amount of each item restated.)

m No.

b

Has the partnership’s or LLC’s income statement been restated for any of the five income statement periods preceding the period on line 2?

m Yes. (Attach an explanation and the amount of each item restated.)

m No.

4 a Worldwide combined net income (loss) from income statement source identified in Part I, line 1 . . . . . . . . . . . . . .

4a

b Indicate accounting standard used for line 4a (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

5 a Net income from nonincludible foreign entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

(

)

b Net loss from nonincludible foreign entities (attach schedule and enter as a positive amount) . . . . . . . . . . . . . . . . .

5b

6 a Net income from nonincludible U.S. entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

(

)

b Net loss from nonincludible U.S. entities (attach schedule and enter as a positive amount) . . . . . . . . . . . . . . . . . . .

6b

7 a Net income (loss) of other foreign disregarded entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

b Net income (loss) of other U.S. disregarded entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

8

Adjustment to eliminations of transactions between includible entities and nonincludible entities (attach schedule)

8

9

Adjustment to reconcile income statement period to taxable year (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . .

9

0

Other adjustments to reconcile to amount on line 11 (attach schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0

Net income (loss) per income statement of the partnership. Combine line 4 through line 10 . . . . . . . . . . . . . . . .

2

Enter the total amount (not just the patnership’s or LLC’s share) of the assets and liabilities of all entities included or removed on the following lines.

Total Assets

Total Liabilities

a

Included on Part I, line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

Removed on Part I, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Removed on Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

Included on Part I, line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7941083

Schedule M-3 (565/568) 2008 Side

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3