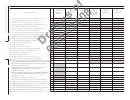

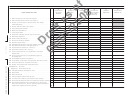

California Schedule M-3 (565/568) Draft - Net Income (Loss) Reconciliation For Certain Partnerships And Limited Liability Companies - 2008 Page 3

ADVERTISEMENT

Part III Reconciliation of Net Income (Loss) per Income Statement of Partnership or LLC with Total Income (Loss) per Return – Expense/Deduction Items

(a)

(b)

(c)

(d)

(e)

(f)

Income (Loss)

Temporary

Permanent

Amounts from

California

Amounts using

Expense/Deduction Items

per Income

Difference

Difference

Federal Schedule

Adjustments

California Law

Statement

M-3 (1065)

Column (d)

1 State and local current income tax expense . . . . . . . . . . . . . . . . . 1

2 State and local deferred income tax expense . . . . . . . . . . . . . . . . 2

3 Foreign current income tax expense (other than foreign

withholding taxes) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Foreign deferred income tax expense . . . . . . . . . . . . . . . . . . . . . . 4

5 Equity-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Meals and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Fines and penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Judgments, damages, awards, and similiar costs . . . . . . . . . . . . 8

9 Guaranteed payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Pension and profit-sharing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Other post-retirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Deferred compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Charitable contribution of cash and tangible property . . . . . . . . . 13

14 Charitable contribution of intangible property . . . . . . . . . . . . . . . 14

15 Organizational expenses per 1 .709-2(a) . . . . . . . . . . . . . . . . . . . . 15

16 Syndication expenses as 1 .709-2(b) . . . . . . . . . . . . . . . . . . . . . . 16

17 Current year acquisition or reorganization investment

banking fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Current year acquisition or reorganization legal and

accounting fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Amortization/impairment of goodwill . . . . . . . . . . . . . . . . . . . . . . 19

20 Amortization of acquisition, reorganization and start-up costs . . . 20

21 Other amortization or impairment write-offs . . . . . . . . . . . . . . . . 21

22 Section 198 environmental remediation costs . . . . . . . . . . . . . . . 22

23a Depletion – Oil & Gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23a

b Depletion – Other than Oil & Gas . . . . . . . . . . . . . . . . . . . . . . . . . 23b

24 Intangible drilling & development costs . . . . . . . . . . . . . . . . . . . . 24

25 Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Bad debt expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Interest expense (attach Form 8916-A) . . . . . . . . . . . . . . . . . . . . 27

28 Purchase versus lease (for purchasers and/or lessees) . . . . . . . . 28

29 Other expense/deduction items with differences (attach schedule) 29

30 Total expense/deduction items . Combine lines 1 through 29 .

Enter here and on Part II, line 24, reporting positive amounts as

negative and negative amounts as positive . . . . . . . . . . . . . . . . . 30

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3