General Instructions For Form N-318 - High Technology Business Investment Tax Credit

ADVERTISEMENT

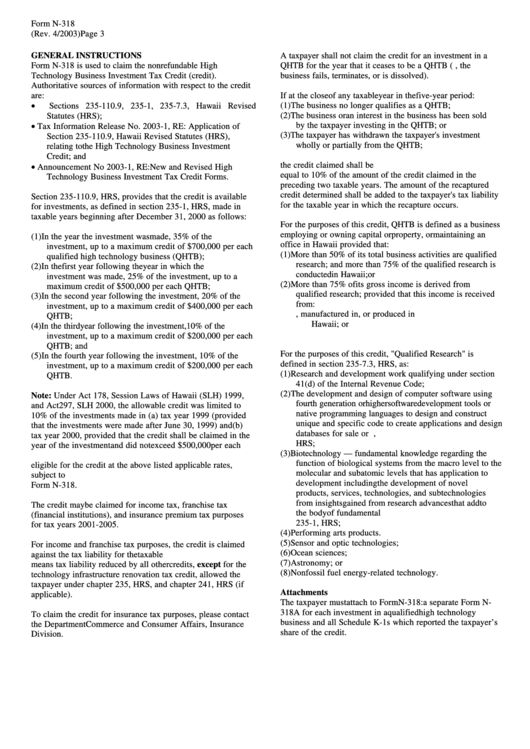

Form N-318

(Rev. 4/2003)

Page 3

GENERAL INSTRUCTIONS

A taxpayer shall not claim the credit for an investment in a

Form N-318 is used to claim the nonrefundable High

QHTB for the year that it ceases to be a QHTB (i.e., the

Technology Business Investment Tax Credit (credit).

business fails, terminates, or is dissolved).

Authoritative sources of information with respect to the credit

are:

If at the close of any taxable year in the five-year period:

•

(1) The business no longer qualifies as a QHTB;

Sections 235-110.9, 235-1, 235-7.3, Hawaii Revised

(2) The business or an interest in the business has been sold

Statutes (HRS);

•

by the taxpayer investing in the QHTB; or

Tax Information Release No. 2003-1, RE: Application of

(3) The taxpayer has withdrawn the taxpayer's investment

Section 235-110.9, Hawaii Revised Statutes (HRS),

wholly or partially from the QHTB;

relating to the High Technology Business Investment

Credit; and

•

the credit claimed shall be recaptured. The recapture shall be

Announcement No 2003-1, RE: New and Revised High

equal to 10% of the amount of the credit claimed in the

Technology Business Investment Tax Credit Forms.

preceding two taxable years. The amount of the recaptured

credit determined shall be added to the taxpayer's tax liability

Section 235-110.9, HRS, provides that the credit is available

for the taxable year in which the recapture occurs.

for investments, as defined in section 235-1, HRS, made in

taxable years beginning after December 31, 2000 as follows:

For the purposes of this credit, QHTB is defined as a business

employing or owning capital or property, or maintaining an

(1) In the year the investment was made, 35% of the

office in Hawaii provided that:

investment, up to a maximum credit of $700,000 per each

(1) More than 50% of its total business activities are qualified

qualified high technology business (QHTB);

research; and more than 75% of the qualified research is

(2) In the first year following the year in which the

conducted in Hawaii; or

investment was made, 25% of the investment, up to a

(2) More than 75% of its gross income is derived from

maximum credit of $500,000 per each QHTB;

qualified research; provided that this income is received

(3) In the second year following the investment, 20% of the

from:

investment, up to a maximum credit of $400,000 per each

A. Products sold from, manufactured in, or produced in

QHTB;

Hawaii; or

(4) In the third year following the investment, 10% of the

B. Services performed in Hawaii.

investment, up to a maximum credit of $200,000 per each

QHTB; and

For the purposes of this credit, " Qualified Research" is

(5) In the fourth year following the investment, 10% of the

defined in section 235-7.3, HRS, as:

investment, up to a maximum credit of $200,000 per each

(1) Research and development work qualifying under section

QHTB.

41(d) of the Internal Revenue Code;

(2) The development and design of computer software using

Note: Under Act 178, Session Laws of Hawaii (SLH) 1999,

fourth generation or higher software development tools or

and Act 297, SLH 2000, the allowable credit was limited to

native programming languages to design and construct

10% of the investments made in (a) tax year 1999 (provided

unique and specific code to create applications and design

that the investments were made after June 30, 1999) and (b)

databases for sale or license. See also section 235-1,

tax year 2000, provided that the credit shall be claimed in the

HRS;

year of the investment and did not exceed $500,000 per each

(3) Biotechnology — fundamental knowledge regarding the

QHTB. The investments made in tax years 1999 and 2000 are

function of biological systems from the macro level to the

eligible for the credit at the above listed applicable rates,

molecular and subatomic levels that has application to

subject to limitations. See specific instructions on Page 4 of

development including the development of novel

Form N-318.

products, services, technologies, and subtechnologies

from insights gained from research advances that add to

The credit may be claimed for income tax, franchise tax

the body of fundamental knowledge. See also section

(financial institutions), and insurance premium tax purposes

235-1, HRS;

for tax years 2001-2005.

(4) Performing arts products.

(5) Sensor and optic technologies;

For income and franchise tax purposes, the credit is claimed

(6) Ocean sciences;

against the tax liability for the taxable year. Tax liability

(7) Astronomy; or

means tax liability reduced by all other credits, except for the

(8) Nonfossil fuel energy-related technology.

technology infrastructure renovation tax credit, allowed the

taxpayer under chapter 235, HRS, and chapter 241, HRS (if

Attachments

applicable).

The taxpayer must attach to Form N-318: a separate Form N-

318A for each investment in a qualified high technology

To claim the credit for insurance tax purposes, please contact

business and all Schedule K-1s which reported the taxpayer’s

the Department Commerce and Consumer Affairs, Insurance

share of the credit.

Division.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3