AZ Form 800NR Page 6 of 6

Instructions

“Non-participating manufacturer” (NPM) means any tobacco

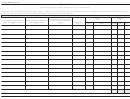

Column H: Enter number of green stamped 20s sold.

product manufacturer who is not a Participating Manufacturer

Column I: Enter number of green stamped 25s sold.

(signatory) to the tobacco Master Settlement Agreement

dated November 29, 1998, referred to in A.R.S.

Total by Reservation: Enter total of each column.

§44-7101(A). A list of participating Manufacturers and their

Balance forwarded from other reservations: Enter the totals of

brands is maintained and updated at the National Association

each attached Schedule 800NR-C.

of Attorneys General (NAAG) web site,

Grand total of all reservations.

“State excise taxes” means taxes imposed on tobacco products

under A.R.S. Title 42, Chapter 3.

Instructions

Column (a): Enter the name and address of the non-partici-

pating manufacturer of the brand of NPM cigarettes reported

in Column (d).

Column (b): Enter the name and address of the person from

whom the brand was purchased if different from the person

identifi ed in Column (a).

Column (c): Enter the name and address of the fi rst importer

of the brand (if known).

Column (d): Enter the complete brand name of the NPM

cigarettes sold in Arizona (do not abbreviate). Do not break the

brand down into subcategories such as regular, menthol, light,

etc. For example, for a cigarette named “Alpha Bravo Gold

Menthol Lights”, report only “Alpha Bravo Gold”. Do not report

as “A B Gold” or “A B Gold Menthol Lights.”

Column (e): Enter the date and invoice number of the

invoice pursuant to which you sold the cigarettes identifi ed in

Column (d).

Column (f): Enter the number of individual NPM cigarettes or

packages of cigarettes, excluding roll-your-own, sold monthly

in Arizona bearing the excise tax stamp of this State (i.e., on

which you have paid state excise taxes).

Certifi cation of No NPM Activity: If you have not sold

any non-participating manufacturer’s cigarettes or roll-your-own

tobacco in Arizona during the applicable period, execute the

form, Non-Resident Distributor’s Certifi cation of No Non-Par-

ticipating Manufacturer’s Activity (In Lieu of Non-Participating

Manufacturer’s Schedules).

SPECIAL INSTRUCTIONS FOR

SCHEDULE 800NR-C:

Complete a separate Schedule 800NR-C for each reservation.

List all sales to authorized Indian retailers. Each transaction

must include the following:

Column A: Enter the registration number and name of the

retailer.

Column B: Enter invoice date.

Column C: Enter invoice number.

Column D: Enter number of blue stamped 20s sold. (For

information only to be included in Section A, line 4.)

Column E: Enter number of blue stamped 25s sold (For

information only to be included in Section A, line 4.)

Column F: Enter number of red stamped 20s sold.

Column G: Enter number of red stamped 25s sold.

ADOR 14-2013 (11/02)

1

1 2

2 3

3 4

4 5

5