Form Ef-1 - Enrollment For Electronic Filing Program

ADVERTISEMENT

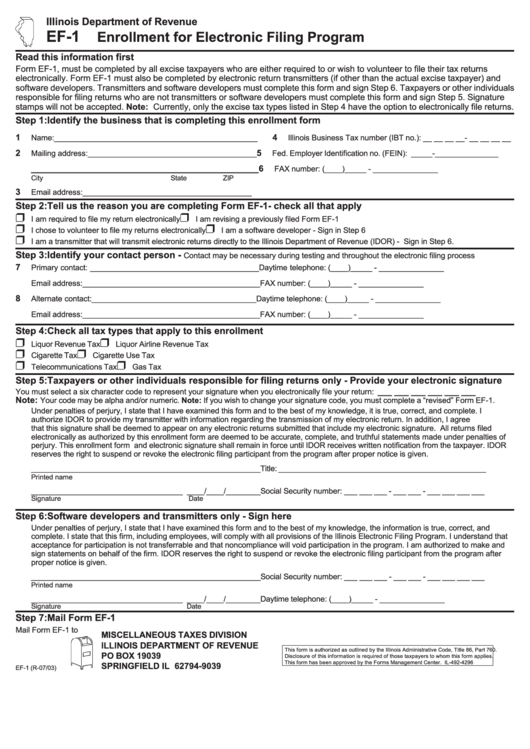

Illinois Department of Revenue

EF-1

Enrollment for Electronic Filing Program

Read this information first

Form EF-1, must be completed by all excise taxpayers who are either required to or wish to volunteer to file their tax returns

electronically. Form EF-1 must also be completed by electronic return transmitters (if other than the actual excise taxpayer) and

software developers. Transmitters and software developers must complete this form and sign Step 6. Taxpayers or other individuals

responsible for filing returns who are not transmitters or software developers must complete this form and sign Step 5. Signature

stamps will not be accepted. Note: Currently, only the excise tax types listed in Step 4 have the option to electronically file returns.

Step 1: Identify the business that is completing this enrollment form

1

4

Name:_______________________________________________

Illinois Business Tax number (IBT no.): __ __ __ __- __ __ __ __

2

5

Mailing address:_______________________________________

Fed. Employer Identification no. (FEIN): _____-_______________

_______________________________________________

6

FAX number: (____)_____ - _______________

City

State

ZIP

3

Email address: _______________________________________

Step 2: Tell us the reason you are completing Form EF-1- check all that apply

I am required to file my return electronically

I am revising a previously filed Form EF-1

I chose to volunteer to file my returns electronically

I am a software developer - Sign in Step 6

I am a transmitter that will transmit electronic returns directly to the Illinois Department of Revenue (IDOR) - Sign in Step 6.

Step 3:

Identify your contact person -

Contact may be necessary during testing and throughout the electronic filing process

7

Primary contact: _______________________________________

Daytime telephone: (____)_____ - _______________

Email address:_________________________________________

FAX number: (____)_____ - _______________

8

Alternate contact: ______________________________________

Daytime telephone: (____)_____ - _______________

Email address:_________________________________________

FAX number: (____)_____ - _______________

Step 4: Check all tax types that apply to this enrollment

Liquor Revenue Tax

Liquor Airline Revenue Tax

Cigarette Tax

Cigarette Use Tax

Telecommunications Tax

Gas Tax

Step 5: Taxpayers or other individuals responsible for filing returns only - Provide your electronic signature

You must select a six character code to represent your signature when you electronically file your return: ___ ___ ___ ___ ___ ___

Note:

Your code may be alpha and/or numeric. Note: If you wish to change your signature code, you must complete a “revised” Form EF-1.

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge, it is true, correct, and complete. I

authorize IDOR to provide my transmitter with information regarding the transmission of my electronic return. In addition, I agree

that this signature shall be deemed to appear on any electronic returns submitted that include my electronic signature. All returns filed

electronically as authorized by this enrollment form are deemed to be accurate, complete, and truthful statements made under penalties of

perjury. This enrollment form and electronic signature shall remain in force until IDOR receives written notification from the taxpayer. IDOR

reserves the right to suspend or revoke the electronic filing participant from the program after proper notice is given.

_____________________________________________________

Title: ________________________________________________

Printed name

___________________________________ ____/____/________

Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Signature

Date

Step 6: Software developers and transmitters only - Sign here

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge, the information is true, correct, and

complete. I state that this firm, including employees, will comply with all provisions of the Illinois Electronic Filing Program. I understand that

acceptance for participation is not transferrable and that noncompliance will void participation in the program. I am authorized to make and

sign statements on behalf of the firm. IDOR reserves the right to suspend or revoke the electronic filing participant from the program after

proper notice is given.

_____________________________________________________

Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Printed name

___________________________________ ____/____/________

Daytime telephone: (____)_____ - _______________

Signature

Date

Step 7: Mail Form EF-1

Mail Form EF-1 to

MISCELLANEOUS TAXES DIVISION

ILLINOIS DEPARTMENT OF REVENUE

This form is authorized as outlined by the Illinois Administrative Code, Title 86, Part 760.

PO BOX 19039

Disclosure of this information is required of those taxpayers to whom this form applies.

This form has been approved by the Forms Management Center. IL-492-4296

SPRINGFIELD IL 62794-9039

EF-1 (R-07/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1