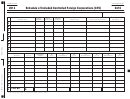

WORKSHEET INSTRUCTIONS

Section A

Line 1. Enter the total number of shares authorized in the Articles of Incorporation.

Line 2. Enter apportionment percentage from form C-8000H filed with your Single Business Tax return or from your Michigan Business Tax

return. If your company is not required to file Single Business or Michigan Business tax returns, enter "not required". If the business

activities are confined solely to this state, 100% of the authorized shares are attributable to this state. If you have any questions

regarding your tax, you may contact Single Business Tax at (517) 636-4700 or Michigan Business Tax at (517) 636-4657.

Line 3. Multiply total authorized shares from Line 1 by the percent of Line 2 for the total number of shares attributable to Michigan.

Line 4. Enter the number of shares previously attributable to Michigan. Corporations that received a Certificate of Authority after

September 30, 1989, have 60,000 shares initially attributable to this state. If you have questions regarding this information, contact

the Document Review Section at (517) 241-6470.

Line 5. Subtract Line 4 from Line 3. If number is greater than '0' and the attributable share increase on Line 5 is 10,000,000 or less, refer to

Section B for the fee. If line 5 is greater than 10,000,000 complete Section C to compute the fee.

Section B

Increase of 60,000 or fewer authorized shares attributable to Michigan

$50.00

Increase of 60,001 - 1,000,000 authorized shares attributable to Michigan

$100.00

Increase of 1,000,001 - 5,000,000 authorized shares attributable to Michigan

$300.00

Increase of 5,000,0001 - 10,000,000 authorized shares attributable to Michigan

$500.00

Section C

Line 1. Enter the increase in attributable shares from Section a, Line 5.

Line 2. Subtract the first 10,000,000 shares from the total attributable shares in Line 1.

Line 3. Enter the increase in attributable shares over 10,000,000.

Line 4. The fee is based on increments of 10,000,000 shares. For a share of 1 to 10,000,000,000 do not divide. Write "1" on Line 4.

For an increase of 10,000,0001 or more shares, divide the number of Line 3 by 10,000,000 to determine the number of

increments. Round any fractional portions up to the next highest "whole" number.

Line 5. Multiply the "whole" number in Line 4 by $1,000.00

Line 6. The fee due on the increase of shares attributable over 10,000,000.

Line 7. the fee due for the initial increase of 10,000,000 shares attributable is $500.00.

Line 8. Add the figures from Line 6 and Line 7 together to calculate the total fee for the increase in shares attributable (add to filing fee

of the document).

1

1 2

2 3

3