State Form 211 - Indiana Metered Pump Sales And Use Tax Return

ADVERTISEMENT

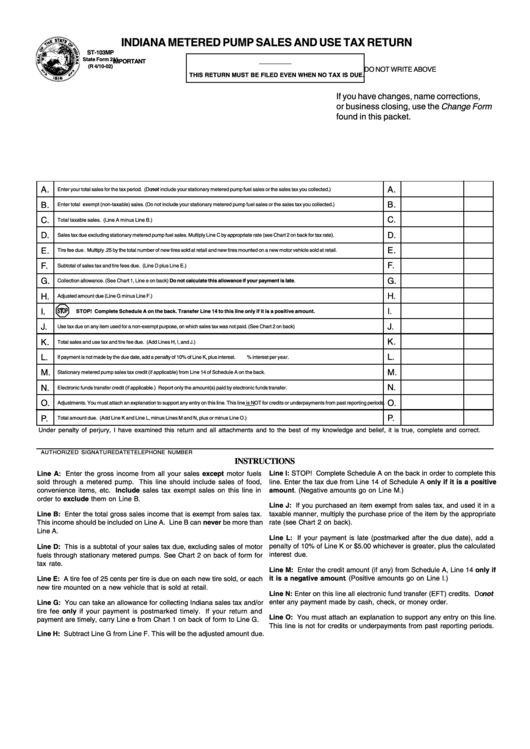

INDIANA METERED PUMP SALES AND USE TAX RETURN

ST-103MP

State Form 211

IMPORTANT

(R 4/10-02)

DO NOT WRITE ABOVE

THIS RETURN MUST BE FILED EVEN WHEN NO TAX IS DUE.

If you have changes, name corrections,

or business closing, use the Change Form

found in this packet.

A.

A.

Enter your total sales for the tax period. (Do not include your stationary metered pump fuel sales or the sales tax you collected.)

B.

B.

Enter total exempt (non-taxable) sales. (Do not include your stationary metered pump fuel sales or the sales tax you collected.)

C.

C.

Total taxable sales. (Line A minus Line B.)

D.

D.

Sales tax due excluding stationary metered pump fuel sales. Multiply Line C by appropriate rate (see Chart 2 on back for tax rate).

E.

E.

Tire fee due. Multiply .25 by the total number of new tires sold at retail and new tires mounted on a new motor vehicle sold at retail.

F.

F.

Subtotal of sales tax and tire fees due. (Line D plus Line E.)

G.

G.

Collection allowance. (See Chart 1, Line e on back) Do not calculate this allowance if your payment is late.

H.

H.

Adjusted amount due (Line G minus Line F.)

I.

I.

STOP! Complete Schedule A on the back. Transfer Line 14 to this line only if it is a positive amount.

J.

J.

Use tax due on any item used for a non-exempt purpose, on which sales tax was not paid. (See Chart 2 on back)

K.

K.

Total sales and use tax and tire fee due. (Add Lines H, I, and J.)

L.

L.

If payment is not made by the due date, add a penalty of 10% of Line K, plus interest.

% interest per year.

M.

M.

Stationary metered pump sales tax credit (if applicable) from Line 14 of Schedule A on the back.

N.

N.

Electronic funds transfer credit (if applicable.) Report only the amount(s) paid by electronic funds transfer.

O.

O.

Adjustments. You must attach an explanation to support any entry on this line. This line is NOT for credits or underpayments from past reporting periods.

P.

P.

Total amount due. (Add Line K and Line L, minus Lines M and N, plus or minus Line O.)

Under penalty of perjury, I have examined this return and all attachments and to the best of my knowledge and belief, it is true, complete and correct.

AUTHORIZED SIGNATURE

DATE

TELEPHONE NUMBER

INSTRUCTIONS

Line I: STOP! Complete Schedule A on the back in order to complete this

Line A: Enter the gross income from all your sales except motor fuels

line. Enter the tax due from Line 14 of Schedule A only if it is a positive

sold through a metered pump. This line should include sales of food,

convenience items, etc. Include sales tax exempt sales on this line in

amount. (Negative amounts go on Line M.)

order to exclude them on Line B.

Line J: If you purchased an item exempt from sales tax, and used it in a

taxable manner, multiply the purchase price of the item by the appropriate

Line B: Enter the total gross sales income that is exempt from sales tax.

rate (see Chart 2 on back).

This income should be included on Line A. Line B can never be more than

Line A.

Line L: If your payment is late (postmarked after the due date), add a

penalty of 10% of Line K or $5.00 whichever is greater, plus the calculated

Line D: This is a subtotal of your sales tax due, excluding sales of motor

interest due.

fuels through stationary metered pumps. See Chart 2 on back of form for

tax rate.

Line M: Enter the credit amount (if any) from Schedule A, Line 14 only if

it is a negative amount . (Positive amounts go on Line I.)

Line E: A tire fee of 25 cents per tire is due on each new tire sold, or each

new tire mounted on a new vehicle that is sold at retail.

Line N: Enter on this line all electronic fund transfer (EFT) credits. Do not

enter any payment made by cash, check, or money order.

Line G: You can take an allowance for collecting Indiana sales tax and/or

tire fee only if your payment is postmarked timely. If your return and

Line O: You must attach an explanation to support any entry on this line.

payment are timely, carry Line e from Chart 1 on back of form to Line G.

This line is not for credits or underpayments from past reporting periods.

Line H: Subtract Line G from Line F. This will be the adjusted amount due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2