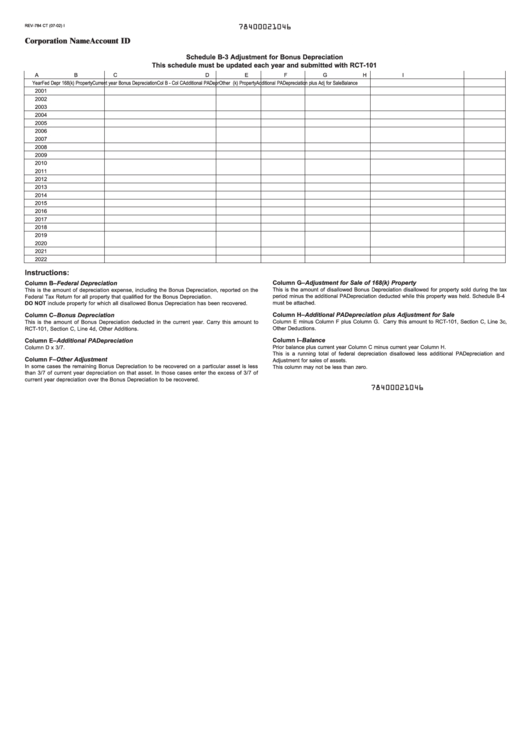

Schedule B-3 (Form Rev-784 Ct) - Adjustment For Bonus Depreciation

ADVERTISEMENT

REV-784 CT (07-02) I

78400021046

Corporation Name

Account ID

Schedule B-3 Adjustment for Bonus Depreciation

This schedule must be updated each year and submitted with RCT-101

A

B

C

D

E

F

G

H

I

Year

Fed Depr 168(k) Property Current year Bonus Depreciation

Col B - Col C

Additional PA Depr

Other Adj.

Adj for Sale of 168(k) Property

Additional PA Depreciation plus Adj for Sale

Balance

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Instructions:

Column G–Adjustment for Sale of 168(k) Property

Column B–Federal Depreciation

This is the amount of disallowed Bonus Depreciation disallowed for property sold during the tax

This is the amount of depreciation expense, including the Bonus Depreciation, reported on the

period minus the additional PA Depreciation deducted while this property was held. Schedule B-4

Federal Tax Return for all property that qualified for the Bonus Depreciation.

must be attached.

DO NOT include property for which all disallowed Bonus Depreciation has been recovered.

Column H–Additional PA Depreciation plus Adjustment for Sale

Column C–Bonus Depreciation

Column E minus Column F plus Column G. Carry this amount to RCT-101, Section C, Line 3c,

This is the amount of Bonus Depreciation deducted in the current year. Carry this amount to

Other Deductions.

RCT-101, Section C, Line 4d, Other Additions.

Column I–Balance

Column E–Additional PA Depreciation

Prior balance plus current year Column C minus current year Column H.

Column D x 3/7.

This is a running total of federal depreciation disallowed less additional PA Depreciation and

Column F–Other Adjustment

Adjustment for sales of assets.

In some cases the remaining Bonus Depreciation to be recovered on a particular asset is less

This column may not be less than zero.

than 3/7 of current year depreciation on that asset. In those cases enter the excess of 3/7 of

current year depreciation over the Bonus Depreciation to be recovered.

78400021046

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2