Schedule B-3 (Form Rev-784 Ct) - Adjustment For Bonus Depreciation Page 2

ADVERTISEMENT

REV-784 CT (07-02) I

78400022047

Corporation Name

Account ID

Year Ending

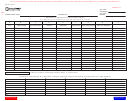

Schedule B-4 Adjustment for Sale of Section 168(k) Property & Recapture of Depreciation on Listed Property

A

B

C

D

E

F

Year of Purchase

Federal Accumulated Depreciation

Disallowed Bonus Depreciation

B-C

Additional PA Depreciation

Adjustment for Sale

Total

Column B–Federal Accumulated Depreciation

Column E–Additional PA Depreciation

Accumulated depreciation used in the calculation of the Gain on the Sale of Sec 168(k) property

as reported on the Federal Income Tax Return. Plus accumulated depreciation used to calculate

Additional depreciation allowed in the calculation of PA Corporate Net Income in the year of

recapture when business use falls to 50% or less.

purchase and in subsequent years. (Col D x 3/7)

This amount should not include Section 179 expense.

Do not include depreciation on property for which all disallowed Bonus Depreciation has been

Column F–Adjustment for Sale

recovered.

Adjustment for the gain on sale of Sec 168(k) property. (Col C - Col E).

Carry total to Column G of Schedule B3

Column C–Disallowed Bonus Depreciation

Bonus Depreciation disallowed in the calculation of PA Corporate Net Income in the year of

purchase.

Do not include Bonus Depreciation which was fully recovered in prior years.

78400022047

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2