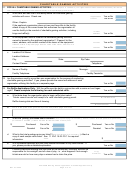

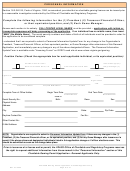

ORGANIZATION INFORMATION

Type of Organization - Please

8.

Veterans

Community

Fraternal

place an "X" in the appropriate

box.

Religious

Charitable

Educational

Other - Explain:

9.

In the last three years, has the organization had a 501(c) status with the

If yes, please explain on a

Internal Revenue Service revoked or suspended?

separate page.

Yes or No

10.

Is the organization in compliance with Federal and State law relative to the

filing, in the last three tax years, of mandated Federal and State tax returns

If no, please explain on a

(i.e ., 990, 990EZ, 990T, 990PF, etc.)?

Yes or No

separate page.

11.

What is the tax period and year of the organization's most recently filed

Internal Revenue Service tax Form 990 (including, but not limited to, Form

990, 990EZ, 990 PF, 990T) or applicable tax return that has been officially

filed and received by the IRS? If no return has been filed, please explain on

a separate page.

Month/Date/Year

Amount

reported on

Line 9.a. of the

Please provide the Total Gross Revenue from Special Events and Activities

Form 990

(Charitable Gaming) as reported to the Internal Revenue Service relative to

the charitable gaming activities conducted by the organization on Form 990 -

Amount

Return of Organization Exempt from Income Tax. If the organization has

reported on

been formally recognized by the IRS as a church, then attach the most

Line 6. of the

recent Statement of Income and Receipts, and Balance Statement.

Short Form 990

12.

If your organization is a part of or related to a national office of an

organization (See . Section 18.2-340.24.A.1.(i.), Code of Virginia, 1950, as

amended), please provide a letter of good standing from the national

organization which indicates that your organization is currently covered by

the group exempt ruling. If the national and/or state office has provided this

information to the Office for the current year, please select N/A (not

applicable).

Yes or No

Copy attached?

If this is not applicable to your organization, place an "X" in the box.

Not Applicable

13.

Is your organization recognized as a corporation or a form of limited liability

If no, explain on a separate page

how the organization is exempt

company, as defined by the Code of Virginia, and authorized to do business

from this requirement.

in Virginia?

Yes or No

Yes

If you answered yes to Item No. 13, is the name as registered at the Virginia

State Corporation the same as provided under Item No. 2 of this application.

If no, please print registration name below.

Yes or No

14.

If you answered yes to Item No. 13, is your organization in good standing

If no, please explain on a

with the Virginia State Corporation Commission?

separate page.

Yes or No

15.

Is the organization registered and in good standing with the Virginia

If no, please explain on a

separate page how the

Department of Agriculture and Consumer Services to solicit charitable

organization is exempt from

contributions in Virginia?

Yes or No

registration.

If you answered Yes to Item No. 15, is the name as registered at the Virginia

Department of Agriculture and Consumer Services the same as provided

under Item No. 2 of this application. If No, please print registration name

below.

Yes or No

Charitable Gaming Permit Application - Renewal Applicants Only

Rev. 07/30/13

Page 2 of 12

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12