Form 720xx - Amended Kentucky Corporation Income Tax Return

ADVERTISEMENT

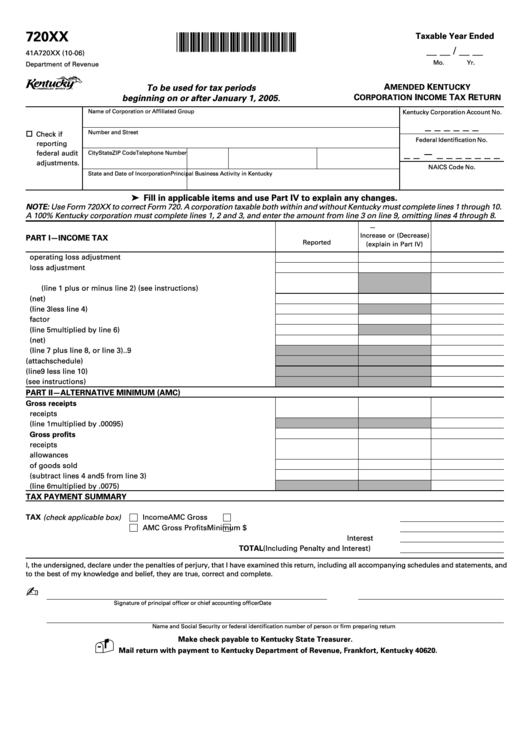

720XX

*0600010206*

Taxable Year Ended

__ __ / __ __

41A720XX (10-06)

Mo.

Yr.

Department of Revenue

A

K

To be used for tax periods

MENDED

ENTUCKY

C

I

T

R

beginning on or after January 1, 2005.

ORPORATION

NCOME

AX

ETURN

Name of Corporation or Affiliated Group

Kentucky Corporation Account No.

_ _ _ _ _ _

Number and Street

Check if

Federal Identification No.

reporting

_ _

_ _ _ _ _ _ _

—

federal audit

City

State

ZIP Code

Telephone Number

adjustments.

NAICS Code No.

State and Date of Incorporation

Principal Business Activity in Kentucky

➤ Fill in applicable items and use Part IV to explain any changes.

NOTE: Use Form 720XX to correct Form 720. A corporation taxable both within and without Kentucky must complete lines 1 through 10.

A 100% Kentucky corporation must complete lines 1, 2 and 3, and enter the amount from line 3 on line 9, omitting lines 4 through 8.

B. Net Change—

A. As Previously

Increase or (Decrease) C. Corrected Amount

PART I—INCOME TAX

Reported

(explain in Part IV)

1. Net income before current net operating loss adjustment .........

1

2. Current net operating loss adjustment .........................................

2

3. Net income after current net operating loss adjustment

(line 1 plus or minus line 2) (see instructions) .............................

3

4. Nonbusiness income (net) ..............................................................

4

5. Total business income (line 3 less line 4) .....................................

5

6. Apportionment factor .....................................................................

6

7. Kentucky business income (line 5 multiplied by line 6) ..............

7

8. Kentucky nonbusiness income (net) .............................................

8

9. Taxable net income before NOLD (line 7 plus line 8, or line 3) ..

9

10. Kentucky NOLD (attach schedule) ................................................. 10

11. Taxable net income after NOLD (line 9 less line 10) .................... 11

12. Total income tax (see instructions) ............................................... 12

PART II—ALTERNATIVE MINIMUM (AMC)

Gross receipts

1. Kentucky gross receipts ..................................................................

1

2. Total tax (line 1 multiplied by .00095) ...........................................

2

Gross profits

3. Kentucky gross receipts ..................................................................

3

4. Kentucky returns and allowances ..................................................

4

5. Kentucky cost of goods sold ..........................................................

5

6. Gross profit (subtract lines 4 and 5 from line 3) ..........................

6

7. Total tax (line 6 multiplied by .0075) .............................................

7

TAX PAYMENT SUMMARY

TAX (check applicable box)

Income

AMC Gross Receipts

Tax ...............

AMC Gross Profits

Minimum $175

Penalty .........

Interest ........

TOTAL (Including Penalty and Interest) ........

I, the undersigned, declare under the penalties of perjury, that I have examined this return, including all accompanying schedules and statements, and

to the best of my knowledge and belief, they are true, correct and complete.

✍

Signature of principal officer or chief accounting officer

Date

Name and Social Security or federal identification number of person or firm preparing return

Make check payable to Kentucky State Treasurer.

Mail return with payment to Kentucky Department of Revenue, Frankfort, Kentucky 40620.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2