Form Tc-41s Draft - Credit For Income Tax Paid To Another State - 2013

ADVERTISEMENT

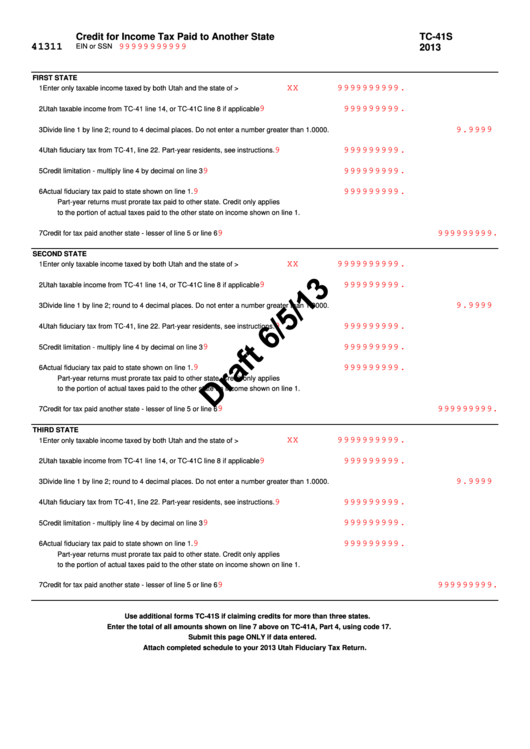

Credit for Income Tax Paid to Another State

TC-41S

41311

2013

EIN or SSN

9 9 9 9 9 9 9 9 9 9 9

FIRST STATE

X X

9 9 9 9 9 9 9 9 9 9 .

1

Enter only taxable income taxed by both Utah and the state of >

9 9 9 9 9 9 9 9 9 9 .

2

Utah taxable income from TC-41 line 14, or TC-41C line 8 if applicable

9 . 9 9 9 9

3

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000.

9 9 9 9 9 9 9 9 9 9 .

4

Utah fiduciary tax from TC-41, line 22. Part-year residents, see instructions.

9 9 9 9 9 9 9 9 9 9 .

5

Credit limitation - multiply line 4 by decimal on line 3

9 9 9 9 9 9 9 9 9 9 .

6

Actual fiduciary tax paid to state shown on line 1.

Part-year returns must prorate tax paid to other state. Credit only applies

to the portion of actual taxes paid to the other state on income shown on line 1.

9 9 9 9 9 9 9 9 9 9 .

7

Credit for tax paid another state - lesser of line 5 or line 6

SECOND STATE

X X

9 9 9 9 9 9 9 9 9 9 .

1

Enter only taxable income taxed by both Utah and the state of >

9 9 9 9 9 9 9 9 9 9 .

2

Utah taxable income from TC-41 line 14, or TC-41C line 8 if applicable

9 . 9 9 9 9

3

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000.

9 9 9 9 9 9 9 9 9 9 .

4

Utah fiduciary tax from TC-41, line 22. Part-year residents, see instructions.

9 9 9 9 9 9 9 9 9 9 .

5

Credit limitation - multiply line 4 by decimal on line 3

9 9 9 9 9 9 9 9 9 9 .

6

Actual fiduciary tax paid to state shown on line 1.

Part-year returns must prorate tax paid to other state. Credit only applies

to the portion of actual taxes paid to the other state on income shown on line 1.

9 9 9 9 9 9 9 9 9 9 .

7

Credit for tax paid another state - lesser of line 5 or line 6

THIRD STATE

X X

9 9 9 9 9 9 9 9 9 9 .

1

Enter only taxable income taxed by both Utah and the state of >

9 9 9 9 9 9 9 9 9 9 .

2

Utah taxable income from TC-41 line 14, or TC-41C line 8 if applicable

9 . 9 9 9 9

3

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000.

9 9 9 9 9 9 9 9 9 9 .

4

Utah fiduciary tax from TC-41, line 22. Part-year residents, see instructions.

9 9 9 9 9 9 9 9 9 9 .

5

Credit limitation - multiply line 4 by decimal on line 3

9 9 9 9 9 9 9 9 9 9 .

6

Actual fiduciary tax paid to state shown on line 1.

Part-year returns must prorate tax paid to other state. Credit only applies

to the portion of actual taxes paid to the other state on income shown on line 1.

9 9 9 9 9 9 9 9 9 9 .

7

Credit for tax paid another state - lesser of line 5 or line 6

Use additional forms TC-41S if claiming credits for more than three states.

Enter the total of all amounts shown on line 7 above on TC-41A, Part 4, using code 17.

Submit this page ONLY if data entered.

Attach completed schedule to your 2013 Utah Fiduciary Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2