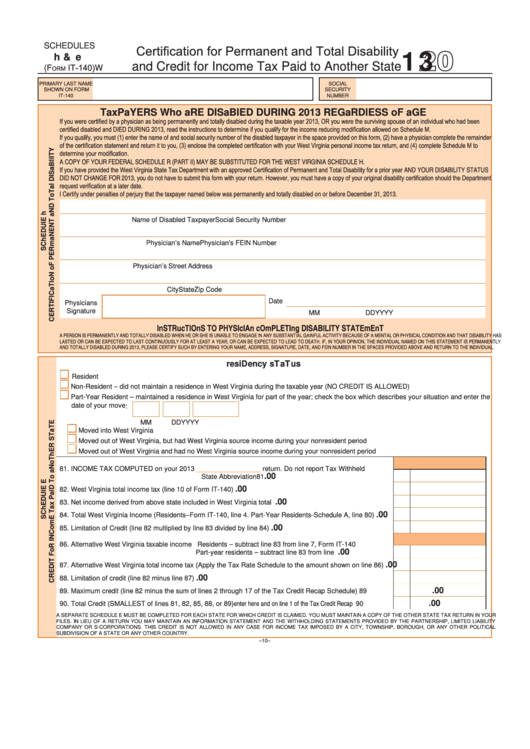

SCHEDuLES

13

Certification for Permanent and Total Disability

h & e

and Credit for Income Tax Paid to another State

IT-140)

(F

W

orm

PRIMaRY LaST NaME

SOCIaL

SHOWN ON FORM

SECuRITY

IT-140

NuMbER

TaxPaYERS Who aRE DISaBlED DURING 2013 REGaRDlESS oF aGE

If you were certified by a physician as being permanently and totally disabled during the taxable year 2013, OR you were the surviving spouse of an individual who had been

certified disabled and DIED DURING 2013, read the instructions to determine if you qualify for the income reducing modification allowed on Schedule M.

If you qualify, you must (1) enter the name of and social security number of the disabled taxpayer in the space provided on this form, (2) have a physician complete the remainder

of the certification statement and return it to you, (3) enclose the completed certification with your West Virginia personal income tax return, and (4) complete Schedule M to

determine your modification.

A COPY OF YOUR FEDERAL SCHEDULE R (PART II) MAY BE SUBSTITUTED FOR THE WEST VIRGINIA SCHEDULE H.

If you have provided the West Virginia State Tax Department with an approved Certification of Permanent and Total Disability for a prior year AND YOUR DISABILITY STATUS

DID NOT CHANGE FOR 2013, you do not have to submit this form with your return. However, you must have a copy of your original disability certification should the Department

request verification at a later date.

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2013.

Name of Disabled Taxpayer

Social Security Number

Physician’s Name

Physician's FEIN Number

Physician’s Street address

City

State

Zip Code

Date

Physicians

Signature

MM

DD

YYYY

InSTRucTIOnS TO PHYSIcIAn cOmPLETIng DISABILITY STATEmEnT

A PERSON IS PERMANENTLY AND TOTALLY DISABLED WHEN HE OR SHE IS UNABLE TO ENGAGE IN ANY SUBSTANTIAL GAINFUL ACTIVITY BECAUSE OF A MENTAL OR PHYSICAL CONDITION AND THAT DISABILITY HAS

LASTED OR CAN BE EXPECTED TO LAST CONTINUOUSLY FOR AT LEAST A YEAR, OR CAN BE EXPECTED TO LEAD TO DEATH. IF, IN YOUR OPINION, THE INDIVIDUAL NAMED ON THIS STATEMENT IS PERMANENTLY

AND TOTALLY DISABLED DURING 2013, PLEASE CERTIFY SUCH BY ENTERING YOUR NAME, ADDRESS, SIGNATURE, DATE, AND FEIN NUMBER IN THE SPACES PROVIDED ABOVE AND RETURN TO THE INDIVIDUAL.

resiDency sTaTus

Resident

Non-Resident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS aLLOWED)

Part-Year Resident – maintained a residence in West Virginia for part of the year; check the box which describes your situation and enter the

date of your move :

MM

DD

YYYY

Moved into West Virginia

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

81. INCOME Tax COMPuTED on your 2013

_________________

return. Do not report Tax Withheld

.00

State abbreviation

81

.00

82. West Virginia total income tax (line 10 of Form IT-140).....................................................................................

82

.00

83. Net income derived from above state included in West Virginia total income...................................................

83

.00

84. Total West Virginia Income (Residents–Form IT-140, line 4. Part-Year Residents-Schedule a, line 80)..........

84

.00

85. Limitation of Credit (line 82 multiplied by line 83 divided by line 84).................................................................

85

86. alternative West Virginia taxable income Residents – subtract line 83 from line 7, Form IT-140

.00

Part-year residents – subtract line 83 from line 84.........................

86

.00

87. alternative West Virginia total income tax (apply the Tax Rate Schedule to the amount shown on line 86).....

87

.00

88. Limitation of credit (line 82 minus line 87).........................................................................................................

88

.00

89. Maximum credit (line 82 minus the sum of lines 2 through 17 of the Tax Credit Recap Schedule)...................

89

90. Total Credit (SMaLLEST of lines 81, 82, 85, 88, or 89) enter here and on line 1 of the Tax Credit Recap Schedule..........

.00

90

a SEPaRaTE SCHEDuLE E MuST bE COMPLETED FOR EaCH STaTE FOR WHICH CREDIT IS CLaIMED. YOu MuST MaINTaIN a COPY OF THE OTHER STaTE Tax RETuRN IN YOuR

FILES. IN LIEu OF a RETuRN YOu MaY MaINTaIN aN INFORMaTION STaTEMENT aND THE WITHHOLDINg STaTEMENTS PROVIDED bY THE PaRTNERSHIP, LIMITED LIabILITY

COMPaNY OR S-CORPORaTIONS. THIS CREDIT IS NOT aLLOWED IN aNY CaSE FOR INCOME Tax IMPOSED bY a CITY, TOWNSHIP, bOROugH, OR aNY OTHER POLITICaL

SubDIVISION OF a STaTE OR aNY OTHER COuNTRY.

–10–

1

1