Application For Individual Income Tax Penalty Amnesty

ADVERTISEMENT

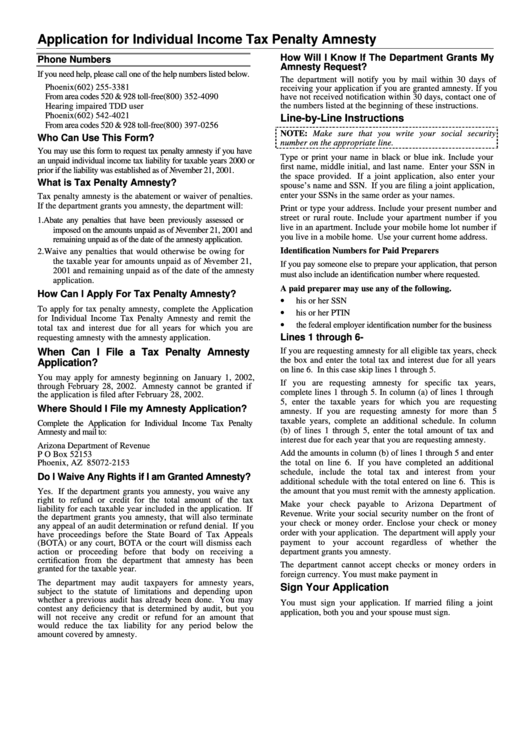

Application for Individual Income Tax Penalty Amnesty

How Will I Know If The Department Grants My

Phone Numbers

Amnesty Request?

If you need help, please call one of the help numbers listed below.

The department will notify you by mail within 30 days of

Phoenix

(602) 255-3381

receiving your application if you are granted amnesty. If you

From area codes 520 & 928 toll-free

(800) 352-4090

have not received notification within 30 days, contact one of

the numbers listed at the beginning of these instructions.

Hearing impaired TDD user

Phoenix

(602) 542-4021

Line-by-Line Instructions

From area codes 520 & 928 toll-free

(800) 397-0256

NOTE: Make sure that you write your social security

Who Can Use This Form?

number on the appropriate line.

You may use this form to request tax penalty amnesty if you have

Type or print your name in black or blue ink. Include your

an unpaid individual income tax liability for taxable years 2000 or

first name, middle initial, and last name. Enter your SSN in

prior if the liability was established as of November 21, 2001.

the space provided. If a joint application, also enter your

What is Tax Penalty Amnesty?

spouse’s name and SSN. If you are filing a joint application,

enter your SSNs in the same order as your names.

Tax penalty amnesty is the abatement or waiver of penalties.

If the department grants you amnesty, the department will:

Print or type your address. Include your present number and

street or rural route. Include your apartment number if you

1.

Abate any penalties that have been previously assessed or

live in an apartment. Include your mobile home lot number if

imposed on the amounts unpaid as of November 21, 2001 and

you live in a mobile home. Use your current home address.

remaining unpaid as of the date of the amnesty application.

Identification Numbers for Paid Preparers

2.

Waive any penalties that would otherwise be owing for

the taxable year for amounts unpaid as of November 21,

If you pay someone else to prepare your application, that person

2001 and remaining unpaid as of the date of the amnesty

must also include an identification number where requested.

application.

A paid preparer may use any of the following.

How Can I Apply For Tax Penalty Amnesty?

•

his or her SSN

To apply for tax penalty amnesty, complete the Application

•

his or her PTIN

for Individual Income Tax Penalty Amnesty and remit the

•

the federal employer identification number for the business

total tax and interest due for all years for which you are

Lines 1 through 6-

requesting amnesty with the amnesty application.

If you are requesting amnesty for all eligible tax years, check

When Can I File a Tax Penalty Amnesty

the box and enter the total tax and interest due for all years

Application?

on line 6. In this case skip lines 1 through 5.

You may apply for amnesty beginning on January 1, 2002,

If you are requesting amnesty for specific tax years,

through February 28, 2002. Amnesty cannot be granted if

complete lines 1 through 5. In column (a) of lines 1 through

the application is filed after February 28, 2002.

5, enter the taxable years for which you are requesting

Where Should I File my Amnesty Application?

amnesty. If you are requesting amnesty for more than 5

taxable years, complete an additional schedule. In column

Complete the Application for Individual Income Tax Penalty

(b) of lines 1 through 5, enter the total amount of tax and

Amnesty and mail to:

interest due for each year that you are requesting amnesty.

Arizona Department of Revenue

Add the amounts in column (b) of lines 1 through 5 and enter

P O Box 52153

the total on line 6. If you have completed an additional

Phoenix, AZ 85072-2153

schedule, include the total tax and interest from your

Do I Waive Any Rights if I am Granted Amnesty?

additional schedule with the total entered on line 6. This is

the amount that you must remit with the amnesty application.

Yes. If the department grants you amnesty, you waive any

right to refund or credit for the total amount of the tax

Make your check payable to Arizona Department of

liability for each taxable year included in the application. If

Revenue. Write your social security number on the front of

the department grants you amnesty, that will also terminate

your check or money order. Enclose your check or money

any appeal of an audit determination or refund denial. If you

order with your application. The department will apply your

have proceedings before the State Board of Tax Appeals

payment to your account regardless of whether the

(BOTA) or any court, BOTA or the court will dismiss each

action or proceeding before that body on receiving a

department grants you amnesty.

certification from the department that amnesty has been

The department cannot accept checks or money orders in

granted for the taxable year.

foreign currency. You must make payment in U.S. dollars.

The department may audit taxpayers for amnesty years,

Sign Your Application

subject to the statute of limitations and depending upon

whether a previous audit has already been done. You may

You must sign your application. If married filing a joint

contest any deficiency that is determined by audit, but you

application, both you and your spouse must sign.

will not receive any credit or refund for an amount that

would reduce the tax liability for any period below the

amount covered by amnesty.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1