Form Ador 91-5364 - Application For Individual Income Tax Penalty Amnesty

ADVERTISEMENT

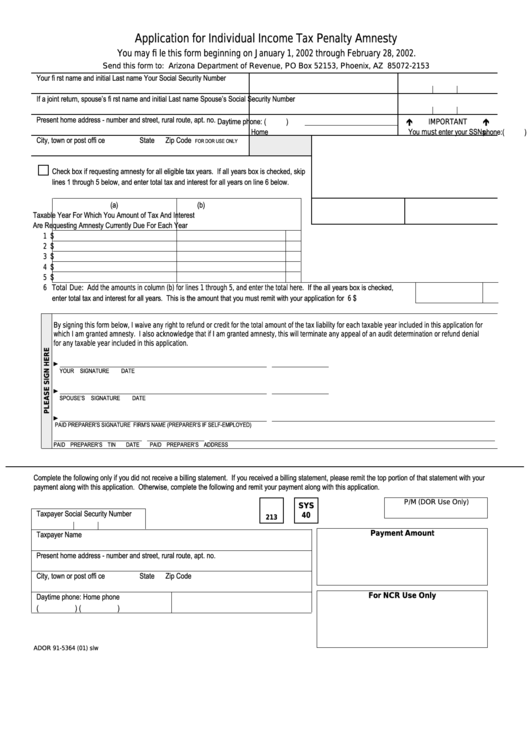

Application for Individual Income Tax Penalty Amnesty

You may fi le this form beginning on January 1, 2002 through February 28, 2002.

Send this form to: Arizona Department of Revenue, PO Box 52153, Phoenix, AZ 85072-2153

Your fi rst name and initial

Last name

Your Social Security Number

If a joint return, spouse’s fi rst name and initial

Last name

Spouse’s Social Security Number

Present home address - number and street, rural route, apt. no.

Daytime phone: (

)

!

IMPORTANT

!

Home phone:

(

)

You must enter your SSNs.

City, town or post offi ce

State

Zip Code

FOR DOR USE ONLY

Check box if requesting amnesty for all eligible tax years. If all years box is checked, skip

lines 1 through 5 below, and enter total tax and interest for all years on line 6 below.

(a)

(b)

Taxable Year For Which You

Amount of Tax And Interest

Are Requesting Amnesty

Currently Due For Each Year

1

$

2

$

3

$

4

$

5

$

6 Total Due: Add the amounts in column (b) for lines 1 through 5, and enter the total here. If the all years box is checked,

enter total tax and interest for all years. This is the amount that you must remit with your application for amnesty ................

6 $

By signing this form below, I waive any right to refund or credit for the total amount of the tax liability for each taxable year included in this application for

which I am granted amnesty. I also acknowledge that if I am granted amnesty, this will terminate any appeal of an audit determination or refund denial

for any taxable year included in this application.

►

YOUR SIGNATURE

DATE

►

SPOUSE’S SIGNATURE

DATE

►

PAID PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PAID PREPARER’S TIN

DATE

PAID PREPARER’S ADDRESS

Complete the following only if you did not receive a billing statement. If you received a billing statement, please remit the top portion of that statement with your

payment along with this application. Otherwise, complete the following and remit your payment along with this application.

P/M (DOR Use Only)

SYS

Taxpayer Social Security Number

40

213

Taxpayer Name

Payment Amount

Present home address - number and street, rural route, apt. no.

City, town or post offi ce

State

Zip Code

Daytime phone:

Home phone

For NCR Use Only

(

)

(

)

ADOR 91-5364 (01) slw

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1