JANUARY 1, 2017

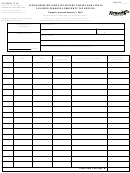

47

Total Cost All Pools (Column A)

$

48

Total Column B Adjustments Per Form 106

$

49

Total Column C Adjusted Cost ALL POOLS

$

$

50

Total Column D True Tax Value of Pools 1, 2, 3 and 4

30% of Line 49, Column C

51

$

52

Greater of Lines 50 or 51 (Must Not Be Less Than 30% of Line 49) 50 IAC 4.2- 4-9

$

0.00

$

53

Additions @ True Tax Value: Equipment Not Placed in Service at Cost

Cost $

X

10% =

54

Permanently Retired Equipment Per Form 106 - 50 IAC 4.2-4-3 (d)**

$

55

Total Additions to Line 52 True Tax Value (Line 53 + Line 54)

Total True Tax Value before adjustment for Abnormal Obsolescence (Line 52 + Line 55)

$

56

Abnormal Obsolescence adjustment Per Form 106 - 50 IAC 4.2-4-8

57

58

Total True Tax Value of Personal Property other than inventory (To Page 1, Form 102 Summary) (Line 56 - Line 57)

$

The total of Permanently Retired Equipment is to be deducted in full in Column B above. The True Tax Value of such is to be computed on the Form 106, and recorded on

* *

Line 54.

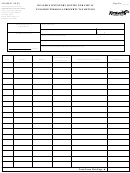

SECTION VI

Information of Not-Owned Personal Property

NOTE: This section is for the reporting of five or less lease agreements. For other leases, the Form 103-N (for the lessee or the person in possession)

and the Form 103-O (for the lessor or the owner of the equipment) should be utilized. For more information on the reporting of leased equipment, refer

to 50 IAC 4.2-8.

NOTE: Failure to properly disclose lease information may result in a double assessment.

Please check one only:

Operating Lease which is assessable to the owner of the equipment (not assessed on this return).

Capital Lease which is assessable to the person in possession and is assessed on this return.

Reported

Date of

Model

on Line

Cost, if

Lease

Number and

Name and Address of Owner

Location of Property

Number, if

Known

(month, day, year)

Description

Applicable

Page 3 of 4

1

1 2

2 3

3