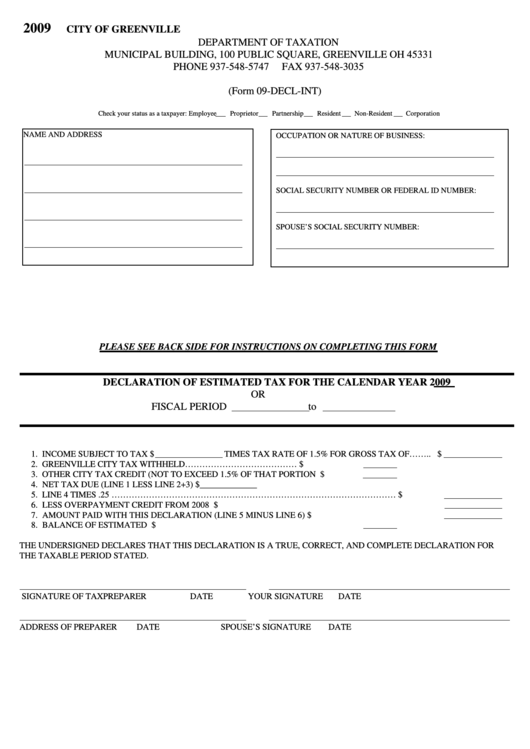

Form 09-Decl-Int - Declaration Of Estimated Tax - 2009

ADVERTISEMENT

2009

CITY OF GREENVILLE

DEPARTMENT OF TAXATION

MUNICIPAL BUILDING, 100 PUBLIC SQUARE, GREENVILLE OH 45331

PHONE 937-548-5747

FAX 937-548-3035

(Form 09-DECL-INT)

Check your status as a taxpayer: Employee

Proprietor

Partnership

Resident

Non-Resident

Corporation

NAME AND ADDRESS

OCCUPATION OR NATURE OF BUSINESS:

SOCIAL SECURITY NUMBER OR FEDERAL ID NUMBER:

SPOUSE’S SOCIAL SECURITY NUMBER:

PLEASE SEE BACK SIDE FOR INSTRUCTIONS ON COMPLETING THIS FORM

DECLARATION OF ESTIMATED TAX FOR THE CALENDAR YEAR 2009

OR

FISCAL PERIOD

to

1. INCOME SUBJECT TO TAX $

TIMES TAX RATE OF 1.5% FOR GROSS TAX OF…….. $

2. GREENVILLE CITY TAX WITHHELD………………………………….......................... $

3. OTHER CITY TAX CREDIT (NOT TO EXCEED 1.5% OF THAT PORTION TAXED... $

4. NET TAX DUE (LINE 1 LESS LINE 2+3)................................................................................................................ $_____________

5. LINE 4 TIMES .25 ………………………………………………………………………………………................. $

6. LESS OVERPAYMENT CREDIT FROM 2008 RETURN....................................................................................... $

7. AMOUNT PAID WITH THIS DECLARATION (LINE 5 MINUS LINE 6)........................................................

$

8. BALANCE OF ESTIMATED TAX....................................................................................... $

THE UNDERSIGNED DECLARES THAT THIS DECLARATION IS A TRUE, CORRECT, AND COMPLETE DECLARATION FOR

THE TAXABLE PERIOD STATED.

SIGNATURE OF TAXPREPARER

DATE

YOUR SIGNATURE

DATE

ADDRESS OF PREPARER

DATE

SPOUSE’S SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1