Form 96-T Instructions - Idaho Magnetic Media Transmittal

ADVERTISEMENT

RO01531-3

11-13-01

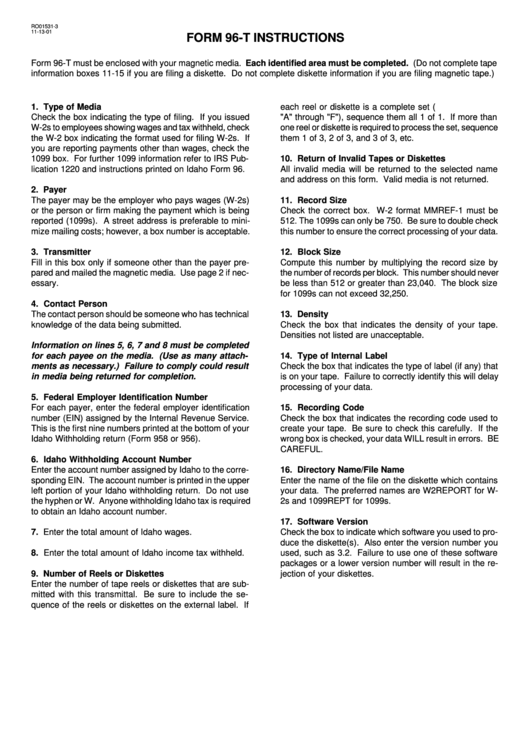

FORM 96-T INSTRUCTIONS

Form 96-T must be enclosed with your magnetic media. Each identified area must be completed. (Do not complete tape

information boxes 11-15 if you are filing a diskette. Do not complete diskette information if you are filing magnetic tape.)

1. Type of Media

each reel or diskette is a complete set (i.e. record types

Check the box indicating the type of filing. If you issued

"A" through "F"), sequence them all 1 of 1. If more than

W-2s to employees showing wages and tax withheld, check

one reel or diskette is required to process the set, sequence

the W-2 box indicating the format used for filing W-2s. If

them 1 of 3, 2 of 3, and 3 of 3, etc.

you are reporting payments other than wages, check the

1099 box. For further 1099 information refer to IRS Pub-

10. Return of Invalid Tapes or Diskettes

lication 1220 and instructions printed on Idaho Form 96.

All invalid media will be returned to the selected name

and address on this form. Valid media is not returned.

2. Payer

The payer may be the employer who pays wages (W-2s)

11. Record Size

or the person or firm making the payment which is being

Check the correct box. W-2 format MMREF-1 must be

reported (1099s). A street address is preferable to mini-

512. The 1099s can only be 750. Be sure to double check

mize mailing costs; however, a box number is acceptable.

this number to ensure the correct processing of your data.

3. Transmitter

12. Block Size

Fill in this box only if someone other than the payer pre-

Compute this number by multiplying the record size by

pared and mailed the magnetic media. Use page 2 if nec-

the number of records per block. This number should never

essary.

be less than 512 or greater than 23,040. The block size

for 1099s can not exceed 32,250.

4. Contact Person

The contact person should be someone who has technical

13. Density

knowledge of the data being submitted.

Check the box that indicates the density of your tape.

Densities not listed are unacceptable.

Information on lines 5, 6, 7 and 8 must be completed

for each payee on the media. (Use as many attach-

14. Type of Internal Label

ments as necessary.) Failure to comply could result

Check the box that indicates the type of label (if any) that

in media being returned for completion.

is on your tape. Failure to correctly identify this will delay

processing of your data.

5. Federal Employer Identification Number

For each payer, enter the federal employer identification

15. Recording Code

number (EIN) assigned by the Internal Revenue Service.

Check the box that indicates the recording code used to

This is the first nine numbers printed at the bottom of your

create your tape. Be sure to check this carefully. If the

Idaho Withholding return (Form 958 or 956).

wrong box is checked, your data WILL result in errors. BE

CAREFUL.

6. Idaho Withholding Account Number

Enter the account number assigned by Idaho to the corre-

16. Directory Name/File Name

sponding EIN. The account number is printed in the upper

Enter the name of the file on the diskette which contains

left portion of your Idaho withholding return. Do not use

your data. The preferred names are W2REPORT for W-

the hyphen or W. Anyone withholding Idaho tax is required

2s and 1099REPT for 1099s.

to obtain an Idaho account number.

17. Software Version

7. Enter the total amount of Idaho wages.

Check the box to indicate which software you used to pro-

duce the diskette(s). Also enter the version number you

8. Enter the total amount of Idaho income tax withheld.

used, such as 3.2. Failure to use one of these software

packages or a lower version number will result in the re-

9. Number of Reels or Diskettes

jection of your diskettes.

Enter the number of tape reels or diskettes that are sub-

mitted with this transmittal. Be sure to include the se-

quence of the reels or diskettes on the external label. If

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1