Instructions For Form Dtf-95 - Change Of Business Information

ADVERTISEMENT

DTF-95 (12/98) (back)

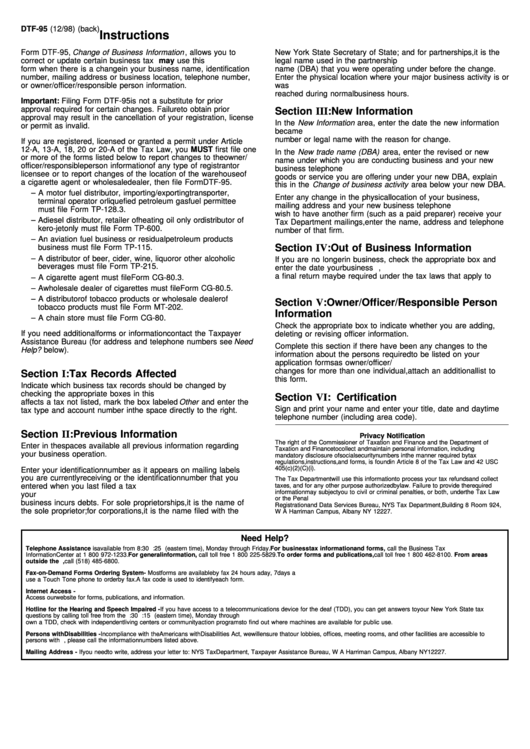

Instructions

Form DTF-95, Change of Business Information , allows you to

New York State Secretary of State; and for partnerships, it is the

correct or update certain business tax records. You may use this

legal name used in the partnership agreement. Enter the trade

form when there is a change in your business name, identification

name (DBA) that you were operating under before the change.

number, mailing address or business location, telephone number,

Enter the physical location where your major business activity is or

or owner/officer/responsible person information.

was conducted. Enter the phone number where you can be

reached during normal business hours.

Important: Filing Form DTF-95 is not a substitute for prior

approval required for certain changes. Failure to obtain prior

Section III: New Information

approval may result in the cancellation of your registration, license

In the New Information area, enter the date the new information

or permit as invalid.

became effective. Indicate any changes in your identification

number or legal name with the reason for change.

If you are registered, licensed or granted a permit under Article

12-A, 13-A, 18, 20 or 20-A of the Tax Law, you MUST first file one

In the New trade name (DBA) area, enter the revised or new

or more of the forms listed below to report changes to the owner/

name under which you are conducting business and your new

officer/responsible person information of any type of registrant or

business telephone number. If there is a change in the type of

licensee or to report changes of the location of the warehouse of

goods or service you are offering under your new DBA, explain

a cigarette agent or wholesale dealer, then file Form DTF-95.

this in the Change of business activity area below your new DBA.

– A motor fuel distributor, importing/exporting transporter,

Enter any change in the physical location of your business,

terminal operator or liquefied petroleum gas fuel permittee

mailing address and your new business telephone number. If you

must file Form TP-128.3.

wish to have another firm (such as a paid preparer) receive your

– A diesel distributor, retailer of heating oil only or distributor of

Tax Department mailings, enter the name, address and telephone

kero-jet only must file Form TP-600.

number of that firm.

– An aviation fuel business or residual petroleum products

Section IV: Out of Business Information

business must file Form TP-115.

– A distributor of beer, cider, wine, liquor or other alcoholic

If you are no longer in business, check the appropriate box and

beverages must file Form TP-215.

enter the date your business closed. In addition to Form DTF-95,

a final return may be required under the tax laws that apply to

– A cigarette agent must file Form CG-80.3.

you. Filing Form DTF-95 does not qualify as a final return.

– A wholesale dealer of cigarettes must file Form CG-80.5.

– A distributor of tobacco products or wholesale dealer of

Section V: Owner/Officer/Responsible Person

tobacco products must file Form MT-202.

Information

– A chain store must file Form CG-80.

Check the appropriate box to indicate whether you are adding,

If you need additional forms or information contact the Taxpayer

deleting or revising officer information.

Assistance Bureau (for address and telephone numbers see Need

Complete this section if there have been any changes to the

Help? below).

information about the persons required to be listed on your

application forms as owner/officer/responsible persons. If there are

changes for more than one individual, attach an additional list to

Section I: Tax Records Affected

this form.

Indicate which business tax records should be changed by

checking the appropriate boxes in this section. If your change

Section VI: Certification

affects a tax not listed, mark the box labeled Other and enter the

Sign and print your name and enter your title, date and daytime

tax type and account number in the space directly to the right.

telephone number (including area code).

Section II: Previous Information

Privacy Notification

The right of the Commissioner of Taxation and Finance and the Department of

Enter in the spaces available all previous information regarding

Taxation and Finance to collect and maintain personal information, including

your business operation.

mandatory disclosure of social security numbers in the manner required by tax

regulations, instructions, and forms, is found in Article 8 of the Tax Law and 42 USC

405(c)(2)(C)(i).

Enter your identification number as it appears on mailing labels

you are currently receiving or the identification number that you

The Tax Department will use this information to process your tax refunds and collect

entered when you last filed a tax return. Enter the legal name of

taxes, and for any other purpose authorized by law. Failure to provide the required

information may subject you to civil or criminal penalties, or both, under the Tax Law

your business. The legal name is the name under which your

or the Penal Law. This information will be maintained by the Director of the

business incurs debts. For sole proprietorships, it is the name of

Registration and Data Services Bureau, NYS Tax Department, Building 8 Room 924,

the sole proprietor; for corporations, it is the name filed with the

W A Harriman Campus, Albany NY 12227.

Need Help?

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time), Monday through Friday. For business tax information and forms, call the Business Tax

Information Center at 1 800 972-1233. For general information, call toll free 1 800 225-5829. To order forms and publications, call toll free 1 800 462-8100. From areas

outside the U.S. and outside Canada, call (518) 485-6800.

Fax-on-Demand Forms Ordering System - Most forms are available by fax 24 hours a day, 7 days a week. Call toll free from the U.S. and Canada 1 800 748-3676. You must

use a Touch Tone phone to order by fax. A fax code is used to identify each form.

Internet Access -

Access our website for forms, publications, and information.

Hotline for the Hearing and Speech Impaired - If you have access to a telecommunications device for the deaf (TDD), you can get answers to your New York State tax

questions by calling toll free from the U.S. and Canada 1 800 634-2110. Assistance is available from 8:30 a.m. to 4:15 p.m. (eastern time), Monday through Friday. If you do not

own a TDD, check with independent living centers or community action programs to find out where machines are available for public use.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are accessible to

persons with disabilities. If you have questions about special accommodations for persons with disabilities, please call the information numbers listed above.

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1