Instructions For Form It-205-T - Allocation Of Estimated Tax Payments To Beneficiaries - 1998

ADVERTISEMENT

IT-205-T (1998) (back)

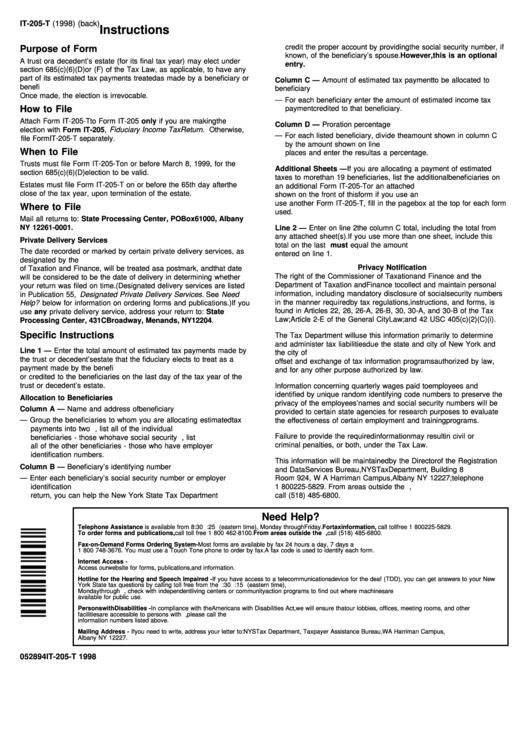

Instructions

credit the proper account by providing the social security number, if

Purpose of Form

known, of the beneficiary’s spouse. However, this is an optional

A trust or a decedent’s estate (for its final tax year) may elect under

entry.

section 685(c)(6)(D) or (F) of the Tax Law, as applicable, to have any

part of its estimated tax payments treated as made by a beneficiary or

Column C — Amount of estimated tax payment to be allocated to

beneficiaries. The fiduciary files Form IT-205-T to make the election.

beneficiary

Once made, the election is irrevocable.

— For each beneficiary enter the amount of estimated income tax

How to File

payment credited to that beneficiary.

Attach Form IT-205-T to Form IT-205 only if you are making the

Column D — Proration percentage

election with Form IT-205, Fiduciary Income Tax Return. Otherwise,

— For each listed beneficiary, divide the amount shown in column C

file Form IT-205-T separately.

by the amount shown on line 1. Carry the result to four decimal

When to File

places and enter the result as a percentage.

Trusts must file Form IT-205-T on or before March 8, 1999, for the

Additional Sheets — If you are allocating a payment of estimated

section 685(c)(6)(D) election to be valid.

taxes to more than 19 beneficiaries, list the additional beneficiaries on

Estates must file Form IT-205-T on or before the 65th day after the

an additional Form IT-205-T or an attached sheet. Follow the format

close of the tax year, upon termination of the estate.

shown on the front of this form if you use an attached sheet. If you

use another Form IT-205-T, fill in the page box at the top for each form

Where to File

used.

Mail all returns to: State Processing Center, PO Box 61000, Albany

NY 12261-0001.

Line 2 — Enter on line 2 the column C total, including the total from

any attached sheet(s). If you use more than one sheet, include this

Private Delivery Services

total on the last page. This combined total must equal the amount

The date recorded or marked by certain private delivery services, as

entered on line 1.

designated by the U.S. Secretary of the Treasury or the Commissioner

Privacy Notification

of Taxation and Finance, will be treated as a postmark, and that date

The right of the Commissioner of Taxation and Finance and the

will be considered to be the date of delivery in determining whether

Department of Taxation and Finance to collect and maintain personal

your return was filed on time. (Designated delivery services are listed

information, including mandatory disclosure of social security numbers

in Publication 55, Designated Private Delivery Services . See Need

in the manner required by tax regulations, instructions, and forms, is

Help? below for information on ordering forms and publications.) If you

found in Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B of the Tax

use any private delivery service, address your return to: State

Law; Article 2-E of the General City Law; and 42 USC 405(c)(2)(C)(i).

Processing Center, 431C Broadway, Menands, NY 12204.

Specific Instructions

The Tax Department will use this information primarily to determine

and administer tax liabilities due the state and city of New York and

Line 1 — Enter the total amount of estimated tax payments made by

the city of Yonkers. We will also use this information for certain tax

the trust or decedent’s estate that the fiduciary elects to treat as a

offset and exchange of tax information programs authorized by law,

payment made by the beneficiaries. This amount is treated as if paid

and for any other purpose authorized by law.

or credited to the beneficiaries on the last day of the tax year of the

trust or decedent’s estate.

Information concerning quarterly wages paid to employees and

identified by unique random identifying code numbers to preserve the

Allocation to Beneficiaries

privacy of the employees’ names and social security numbers will be

Column A — Name and address of beneficiary

provided to certain state agencies for research purposes to evaluate

— Group the beneficiaries to whom you are allocating estimated tax

the effectiveness of certain employment and training programs.

payments into two categories. First, list all of the individual

Failure to provide the required information may result in civil or

beneficiaries - those who have social security numbers. Second, list

criminal penalties, or both, under the Tax Law.

all of the other beneficiaries - those who have employer

identification numbers.

This information will be maintained by the Director of the Registration

Column B — Beneficiary’s identifying number

and Data Services Bureau, NYS Tax Department, Building 8

— Enter each beneficiary’s social security number or employer

Room 924, W A Harriman Campus, Albany NY 12227; telephone

identification number. For those beneficiaries who may file a joint

1 800 225-5829. From areas outside the U.S. and outside Canada,

return, you can help the New York State Tax Department

call (518) 485-6800.

Need Help?

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time), Monday through Friday. For tax information, call toll free 1 800 225-5829.

To order forms and publications, call toll free 1 800 462-8100. From areas outside the U.S. and outside Canada, call (518) 485-6800.

Fax-on-Demand Forms Ordering System - Most forms are available by fax 24 hours a day, 7 days a week. Call toll free from the U.S. and Canada

1 800 748-3676. You must use a Touch Tone phone to order by fax. A fax code is used to identify each form.

Internet Access -

Access our website for forms, publications, and information.

Hotline for the Hearing and Speech Impaired - If you have access to a telecommunications device for the deaf (TDD), you can get answers to your New

York State tax questions by calling toll free from the U.S. and Canada 1 800 634-2110. Assistance is available from 8:30 a.m. to 4:15 p.m. (eastern time),

Monday through Friday. If you do not own a TDD, check with independent living centers or community action programs to find out where machines are

available for public use.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other

facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, please call the

information numbers listed above.

Mailing Address - If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus,

Albany NY 12227.

052894

IT-205-T 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1