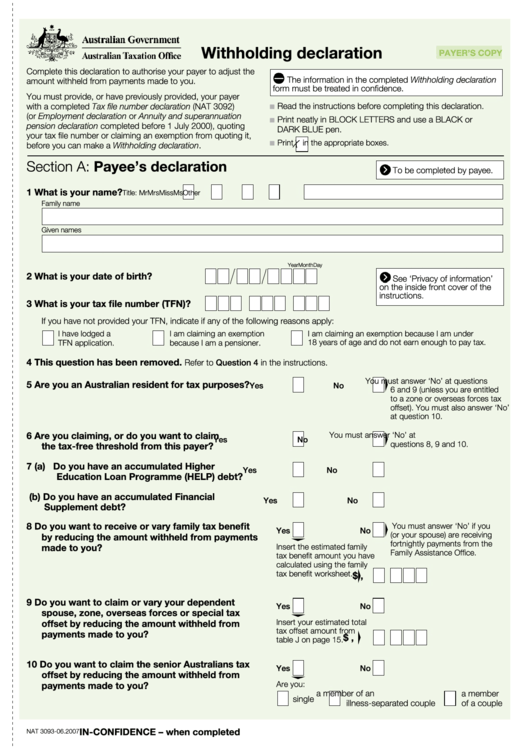

Withholding Declaration - Australian Government Taxation Office

ADVERTISEMENT

withholding declaration

payer’s Copy

complete this declaration to authorise your payer to adjust the

the information in the completed Withholding declaration

amount withheld from payments made to you.

form must be treated in confidence.

you must provide, or have previously provided, your payer

with a completed Tax file number declaration (nat 3092)

read the instructions before completing this declaration.

n

(or Employment declaration or Annuity and superannuation

print neatly in BlocK letters and use a BlacK or

n

pension declaration completed before 1 July 2000), quoting

DarK Blue pen.

your tax file number or claiming an exemption from quoting it,

print

in the appropriate boxes.

X

before you can make a Withholding declaration.

n

section a: payee’s declaration

to be completed by payee.

1

what is your name?

title:

mr

mrs

miss

ms

other

Family name

Given names

Day

month

year

2

what is your date of birth?

see ‘privacy of information’

on the inside front cover of the

instructions.

3

what is your tax file number (tfn)?

if you have not provided your tFn, indicate if any of the following reasons apply:

i have lodged a

i am claiming an exemption

i am claiming an exemption because i am under

18 years of age and do not earn enough to pay tax.

tFn application.

because i am a pensioner.

4

this question has been removed.

refer to Question 4 in the instructions.

you must answer ‘no’ at questions

5

are you an australian resident for tax purposes?

Yes

No

6 and 9 (unless you are entitled

to a zone or overseas forces tax

offset). you must also answer ‘no’

at question 10.

6

are you claiming, or do you want to claim

you must answer ‘no’ at

Yes

No

questions 8, 9 and 10.

the tax‑free threshold from this payer?

7

(a) do you have an accumulated higher

Yes

No

education loan programme (help) debt?

(b) do you have an accumulated financial

Yes

No

supplement debt?

8

do you want to receive or vary family tax benefit

you must answer ‘no’ if you

Yes

No

(or your spouse) are receiving

by reducing the amount withheld from payments

fortnightly payments from the

made to you?

insert the estimated family

Family assistance office.

tax benefit amount you have

calculated using the family

tax benefit worksheet.

$

,

9

do you want to claim or vary your dependent

Yes

No

spouse, zone, overseas forces or special tax

insert your estimated total

offset by reducing the amount withheld from

tax offset amount from

payments made to you?

$

,

table J on page 15.

10 do you want to claim the senior australians tax

Yes

No

offset by reducing the amount withheld from

are you:

payments made to you?

a member of an

a member

single

illness-separated couple

of a couple

In‑ConfIdenCe – when completed

nat 3093-06.2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3