Instructions For Form Mo-Tc - Miscellaneous Income Tax Credits

ADVERTISEMENT

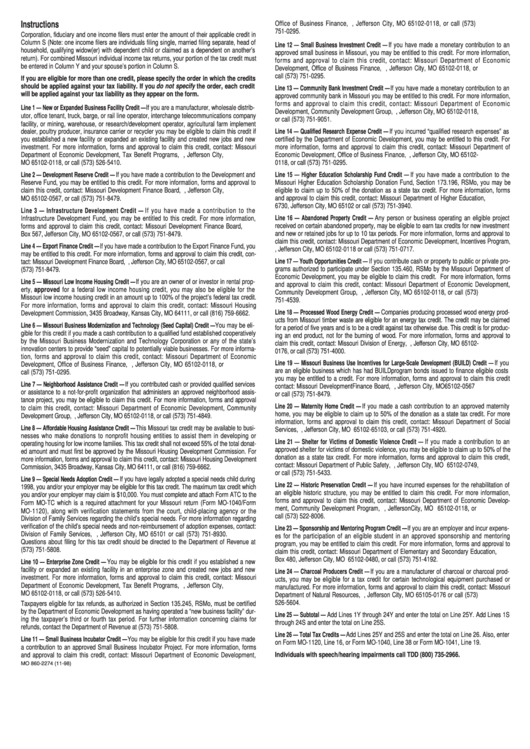

Instructions

Office of Business Finance, P.O. Box 118, Jefferson City, MO 65102-0118, or call (573)

751-0295.

Corporation, fiduciary and one income filers must enter the amount of their applicable credit in

Column S (Note: one income filers are individuals filing single, married filing separate, head of

Line 12 — Small Business Investment Credit — If you have made a monetary contribution to an

household, qualifying widow(er) with dependent child or claimed as a dependent on another’s

approved small business in Missouri, you may be entitled to this credit. For more information,

return). For combined Missouri individual income tax returns, your portion of the tax credit must

forms and approval to claim this credit, contact: Missouri Department of Economic

be entered in Column Y and your spouse’s portion in Column S.

Development, Office of Business Finance, P.O. Box 118, Jefferson City, MO 65102-0118, or

call (573) 751-0295.

If you are eligible for more than one credit, please specify the order in which the credits

should be applied against your tax liability. If you do not specify the order, each credit

Line 13 — Community Bank Investment Credit — If you have made a monetary contribution to an

will be applied against your tax liability as they appear on the form.

approved community bank in Missouri you may be entitled to this credit. For more information,

forms and approval to claim this credit, contact: Missouri Department of Economic

Line 1 — New or Expanded Business Facility Credit — If you are a manufacturer, wholesale distrib-

Development, Community Development Group, P.O. Box 118, Jefferson City, MO 65102-0118,

utor, office tenant, truck, barge, or rail line operator, interchange telecommunications company

or call (573) 751-9051.

facility, or mining, warehouse, or research/development operator, agricultural farm implement

dealer, poultry producer, insurance carrier or recycler you may be eligible to claim this credit if

Line 14 — Qualified Research Expense Credit — If you incurred “qualified research expenses” as

you established a new facility or expanded an existing facility and created new jobs and new

certified by the Department of Economic Development, you may be entitled to this credit. For

investment. For more information, forms and approval to claim this credit, contact: Missouri

more information, forms and approval to claim this credit, contact: Missouri Department of

Department of Economic Development, Tax Benefit Programs, P.O. Box 118, Jefferson City,

Economic Development, Office of Business Finance, P.O. Box 118, Jefferson City, MO 65102-

MO 65102-0118, or call (573) 526-5410.

0118, or call (573) 751-0295.

Line 2 — Development Reserve Credit — If you have made a contribution to the Development and

Line 15 — Higher Education Scholarship Fund Credit — If you have made a contribution to the

Reserve Fund, you may be entitled to this credit. For more information, forms and approval to

Missouri Higher Education Scholarship Donation Fund, Section 173.196, RSMo, you may be

claim this credit, contact: Missouri Development Finance Board, P.O. Box 567, Jefferson City,

eligible to claim up to 50% of the donation as a state tax credit. For more information, forms

MO 65102-0567, or call (573) 751-8479.

and approval to claim this credit, contact: Missouri Department of Higher Education, P.O. Box

6730, Jefferson City, MO 65102 or call (573) 751-3940.

Line 3 — Infrastructure Development Credit — If you have made a contribution to the

Infrastructure Development Fund, you may be entitled to this credit. For more information,

Line 16 — Abandoned Property Credit — Any person or business operating an eligible project

received on certain abandoned property, may be eligible to earn tax credits for new investment

forms and approval to claim this credit, contact: Missouri Development Finance Board, P.O.

and new or retained jobs for up to 10 tax periods. For more information, forms and approval to

Box 567, Jefferson City, MO 65102-0567, or call (573) 751-8479.

claim this credit, contact: Missouri Department of Economic Development, Incentives Program,

Line 4 — Export Finance Credit — If you have made a contribution to the Export Finance Fund, you

P.O. Box 118, Jefferson City, MO 65102-0118 or call (573) 751-0717.

may be entitled to this credit. For more information, forms and approval to claim this credit, con-

Line 17 — Youth Opportunities Credit — If you contribute cash or property to public or private pro-

tact: Missouri Development Finance Board, P.O. Box 567, Jefferson City, MO 65102-0567, or call

grams authorized to participate under Section 135.460, RSMo by the Missouri Department of

(573) 751-8479.

Economic Development, you may be eligible to claim this credit. For more information, forms

Line 5 — Missouri Low Income Housing Credit — If you are an owner of or investor in rental prop-

and approval to claim this credit, contact: Missouri Department of Economic Development,

erty, approved for a federal low income housing credit, you may also be eligible for the

Community Development Group, P.O. Box 118, Jefferson City, MO 65102-0118, or call (573)

Missouri low income housing credit in an amount up to 100% of the project’s federal tax credit.

751-4539.

For more information, forms and approval to claim this credit, contact: Missouri Housing

Line 18 — Processed Wood Energy Credit — Companies producing processed wood energy prod-

Development Commission, 3435 Broadway, Kansas City, MO 64111, or call (816) 759-6662.

ucts from Missouri timber waste are eligible for an energy tax credit. The credit may be claimed

Line 6 — Missouri Business Modernization and Technology (Seed Capital) Credit — You may be eli-

for a period of five years and is to be a credit against tax otherwise due. This credit is for produc-

gible for this credit if you made a cash contribution to a qualified fund established cooperatively

ing an end product, not for the burning of wood. For more information, forms and approval to

by the Missouri Business Modernization and Technology Corporation or any of the state’s

claim this credit, contact: Missouri Division of Energy, P.O. Box 176, Jefferson City, MO 65102-

innovation centers to provide “seed” capital to potentially viable businesses. For more informa-

0176, or call (573) 751-4000.

tion, forms and approval to claim this credit, contact: Missouri Department of Economic

Line 19 — Missouri Business Use Incentives for Large-Scale Development (BUILD) Credit — If you

Development, Office of Business Finance, P.O. Box 118, Jefferson City, MO 65102-0118, or

are an eligible business which has had BUILD program bonds issued to finance eligible costs

call (573) 751-0295.

you may be entitled to a credit. For more information, forms and approval to claim this credit

Line 7 — Neighborhood Assistance Credit — If you contributed cash or provided qualified services

contact: Missouri Development Finance Board, P.O. Box 567, Jefferson City, MO 65102-0567

or assistance to a not-for-profit organization that administers an approved neighborhood assis-

or call (573) 751-8479.

tance project, you may be eligible to claim this credit. For more information, forms and approval

Line 20 — Maternity Home Credit — If you made a cash contribution to an approved maternity

to claim this credit, contact: Missouri Department of Economic Development, Community

home, you may be eligible to claim up to 50% of the donation as a state tax credit. For more

Development Group, P.O. Box 118, Jefferson City, MO 65102-0118, or call (573) 751-4849.

information, forms and approval to claim this credit, contact: Missouri Department of Social

Line 8 — Affordable Housing Assistance Credit — This Missouri tax credit may be available to busi-

Services, P.O. Box 88, Jefferson City, MO 65102-65103, or call (573) 751-4920.

nesses who make donations to nonprofit housing entities to assist them in developing or

Line 21 — Shelter for Victims of Domestic Violence Credit — If you made a contribution to an

operating housing for low income families. This tax credit shall not exceed 55% of the total donat-

approved shelter for victims of domestic violence, you may be eligible to claim up to 50% of the

ed amount and must first be approved by the Missouri Housing Development Commission. For

donation as a state tax credit. For more information, forms and approval to claim this credit,

more information, forms and approval to claim this credit, contact: Missouri Housing Development

contact: Missouri Department of Public Safety, P.O. Box 749, Jefferson City, MO 65102-0749,

Commission, 3435 Broadway, Kansas City, MO 64111, or call (816) 759-6662.

or call (573) 751-5433.

Line 9 — Special Needs Adoption Credit — If you have legally adopted a special needs child during

Line 22 — Historic Preservation Credit — If you have incurred expenses for the rehabilitation of

1998, you and/or your employer may be eligible for this tax credit. The maximum tax credit which

an eligible historic structure, you may be entitled to claim this credit. For more information,

you and/or your employer may claim is $10,000. You must complete and attach Form ATC to the

forms and approval to claim this credit, contact: Missouri Department of Economic Develop-

Form MO-TC which is a required attachment for your Missouri return (Form MO-1040/Form

ment, Community Development Program, P.O. Box 118, Jefferson City, MO 65102-0118, or

MO-1120), along with verification statements from the court, child-placing agency or the

call (573) 522-8006.

Division of Family Services regarding the child’s special needs. For more information regarding

verification of the child’s special needs and non-reimbursement of adoption expenses, contact:

Line 23 — Sponsorship and Mentoring Program Credit — If you are an employer and incur expens-

Division of Family Services, P.O. Box 88, Jefferson City, MO 65101 or call (573) 751-8930.

es for the participation of an eligible student in an approved sponsorship and mentoring

Questions about filing for this tax credit should be directed to the Department of Revenue at

program, you may be entitled to claim this credit. For more information, forms and approval to

(573) 751-5808.

claim this credit, contact: Missouri Department of Elementary and Secondary Education, P.O.

Box 480, Jefferson City, MO 65102-0480, or call (573) 751-4192.

Line 10 — Enterprise Zone Credit — You may be eligible for this credit if you established a new

facility or expanded an existing facility in an enterprise zone and created new jobs and new

Line 24 — Charcoal Producers Credit — If you are a manufacturer of charcoal or charcoal prod-

investment. For more information, forms and approval to claim this credit, contact: Missouri

ucts, you may be eligible for a tax credit for certain technological equipment purchased or

Department of Economic Development, Tax Benefit Programs, P.O. Box 118, Jefferson City,

manufactured. For more information, forms and approval to claim this credit, contact: Missouri

MO 65102-0118, or call (573) 526-5410.

Department of Natural Resources, P.O. Box 176, Jefferson City, MO 65105-0176 or call (573)

526-5604.

Taxpayers eligible for tax refunds, as authorized in Section 135.245, RSMo, must be certified

by the Department of Economic Development as having operated a “new business facility” dur-

Line 25 — Subtotal — Add Lines 1Y through 24Y and enter the total on Line 25Y. Add Lines 1S

ing the taxpayer’s third or fourth tax period. For further information concerning claims for

through 24S and enter the total on Line 25S.

refunds, contact the Department of Revenue at (573) 751-5808.

Line 26 — Total Tax Credits — Add Lines 25Y and 25S and enter the total on Line 26. Also, enter

Line 11 — Small Business Incubator Credit — You may be eligible for this credit if you have made

on Form MO-1120, Line 16, or Form MO-1040, Line 38 or Form MO-1041, Line 19.

a contribution to an approved Small Business Incubator Project. For more information, forms

Individuals with speech/hearing impairments call TDD (800) 735-2966.

and approval to claim this credit, contact: Missouri Department of Economic Development,

MO 860-2274 (11-98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1