Form Ct-1120a-Lp - Corporation Business Tax Return Apportionment Of Limited Partnership Interests

ADVERTISEMENT

Department of Revenue Services

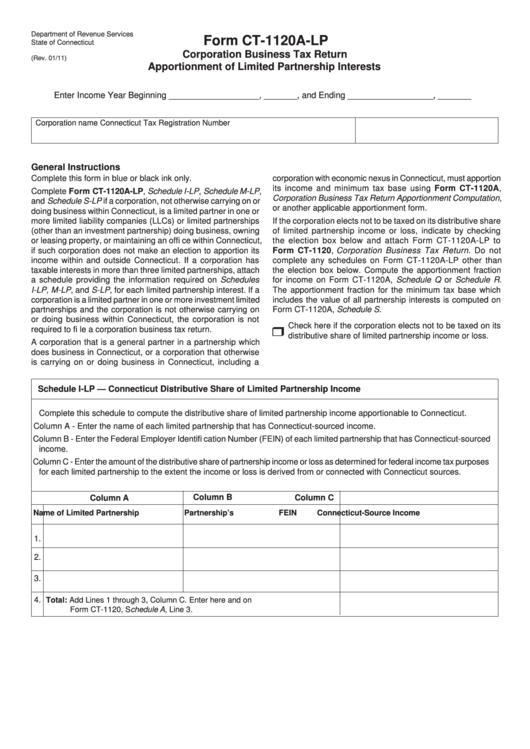

Form CT-1120A-LP

State of Connecticut

Corporation Business Tax Return

(Rev. 01/11)

Apportionment of Limited Partnership Interests

Enter Income Year Beginning ___________________, _______, and Ending __________________, _______

Corporation name

Connecticut Tax Registration Number

General Instructions

Complete this form in blue or black ink only.

corporation with economic nexus in Connecticut, must apportion

its income and minimum tax base using Form CT-1120A,

Complete Form CT-1120A-LP, Schedule I-LP, Schedule M-LP,

Corporation Business Tax Return Apportionment Computation,

and Schedule S-LP if a corporation, not otherwise carrying on or

or another applicable apportionment form.

doing business within Connecticut, is a limited partner in one or

more limited liability companies (LLCs) or limited partnerships

If the corporation elects not to be taxed on its distributive share

(other than an investment partnership) doing business, owning

of limited partnership income or loss, indicate by checking

or leasing property, or maintaining an offi ce within Connecticut,

the election box below and attach Form CT-1120A-LP to

if such corporation does not make an election to apportion its

Form CT-1120, Corporation Business Tax Return. Do not

income within and outside Connecticut. If a corporation has

complete any schedules on Form CT-1120A-LP other than

taxable interests in more than three limited partnerships, attach

the election box below. Compute the apportionment fraction

a schedule providing the information required on Schedules

for income on Form CT-1120A, Schedule Q or Schedule R.

I-LP, M-LP, and S-LP, for each limited partnership interest. If a

The apportionment fraction for the minimum tax base which

corporation is a limited partner in one or more investment limited

includes the value of all partnership interests is computed on

partnerships and the corporation is not otherwise carrying on

Form CT-1120A, Schedule S.

or doing business within Connecticut, the corporation is not

Check here if the corporation elects not to be taxed on its

required to fi le a corporation business tax return.

distributive share of limited partnership income or loss.

A corporation that is a general partner in a partnership which

does business in Connecticut, or a corporation that otherwise

is carrying on or doing business in Connecticut, including a

Schedule I-LP —

Connecticut Distributive Share of Limited Partnership Income

Complete this schedule to compute the distributive share of limited partnership income apportionable to Connecticut.

Column A - Enter the name of each limited partnership that has Connecticut-sourced income.

Column B - Enter the Federal Employer Identifi cation Number (FEIN) of each limited partnership that has Connecticut-sourced

income.

Column C - Enter the amount of the distributive share of partnership income or loss as determined for federal income tax purposes

for each limited partnership to the extent the income or loss is derived from or connected with Connecticut sources.

Column B

Column C

Column A

Name of Limited Partnership

Partnership’s FEIN

Connecticut-Source Income

1.

2.

3.

4.

Total: Add Lines 1 through 3, Column C. Enter here and on

Form CT-1120, Schedule A, Line 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2