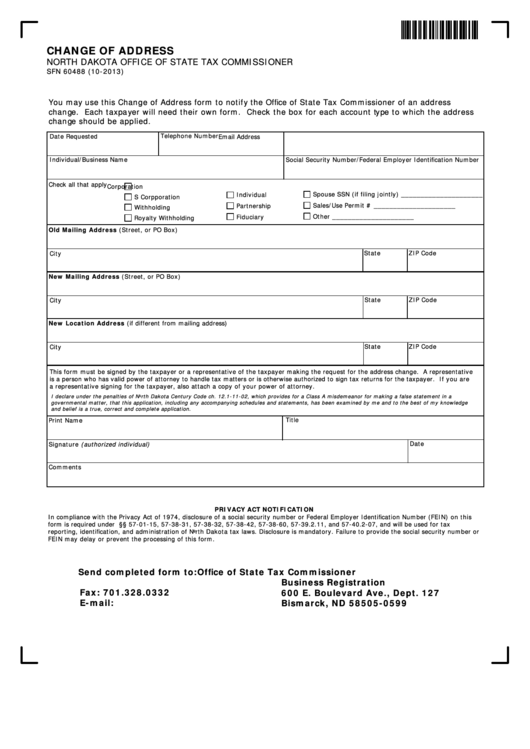

CHANGE OF ADDRESS

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 60488 (10-2013)

You may use this Change of Address form to notify the Office of State Tax Commissioner of an address

change. Each taxpayer will need their own form. Check the box for each account type to which the address

change should be applied.

Telephone Number

Date Requested

Email Address

Individual/Business Name

Social Security Number/Federal Employer Identification Number

Check all that apply

Corporation

Spouse SSN (if filing jointly) _____________________

Individual

S Corpporation

Sales/Use Permit # _____________________

Partnership

Withholding

Other _____________________

Fiduciary

Royalty Withholding

Old Mailing Address (Street, or PO Box)

State

ZIP Code

City

New Mailing Address (Street, or PO Box)

State

ZIP Code

City

New Location Address (if different from mailing address)

State

ZIP Code

City

This form must be signed by the taxpayer or a representative of the taxpayer making the request for the address change. A representative

is a person who has valid power of attorney to handle tax matters or is otherwise authorized to sign tax returns for the taxpayer. If you are

a representative signing for the taxpayer, also attach a copy of your power of attorney.

I declare under the penalties of North Dakota Century Code ch. 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a

governmental matter, that this application, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge

and belief is a true, correct and complete application.

Print Name

Title

Date

Signature (authorized individual)

Comments

PRIVACY ACT NOTIFICATION

In compliance with the Privacy Act of 1974, disclosure of a social security number or Federal Employer Identification Number (FEIN) on this

form is required under N.D.C.C. §§ 57-01-15, 57-38-31, 57-38-32, 57-38-42, 57-38-60, 57-39.2.11, and 57-40.2-07, and will be used for tax

reporting, identification, and administration of North Dakota tax laws. Disclosure is mandatory. Failure to provide the social security number or

FEIN may delay or prevent the processing of this form.

Send completed form to:

Office of State Tax Commissioner

Business Registration

Fax: 701.328.0332

600 E. Boulevard Ave., Dept. 127

E-mail: taxregistration@nd.gov

Bismarck, ND 58505-0599

1

1