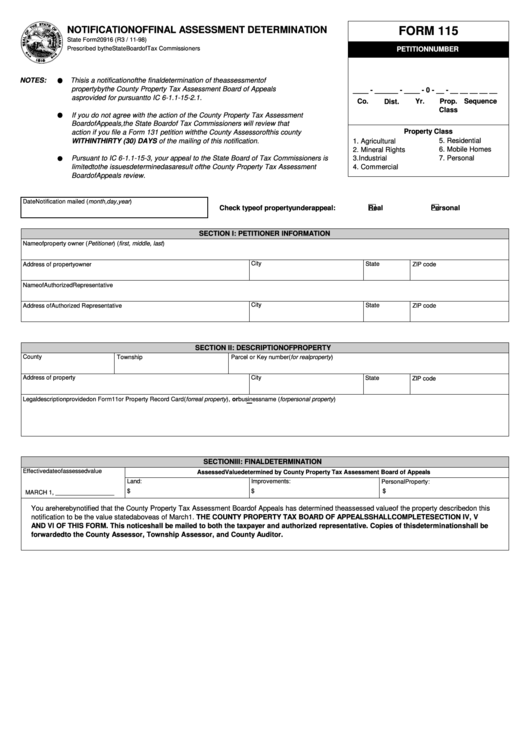

NOTIFICATION OF FINAL ASSESSMENT DETERMINATION

FORM 115

State Form 20916 (R3 / 11-98)

Prescribed by the State Board of Tax Commissioners

PETITION NUMBER

NOTES:

This is a notification of the final determination of the assessment of

property by the County Property Tax Assessment Board of Appeals

__ __ - __ __ __ - __ __ - 0 - __ - __ __ __ __ __

as provided for pursuant to IC 6-1.1-15-2.1.

Co.

Yr.

Prop.

Sequence

Dist.

Class

If you do not agree with the action of the County Property Tax Assessment

Board of Appeals, the State Board of Tax Commissioners will review that

Property Class

action if you file a Form 131 petition with the County Assessor of this county

5. Residential

WITHIN THIRTY (30) DAYS of the mailing of this notification.

1. Agricultural

2. Mineral Rights

6. Mobile Homes

7. Personal

Pursuant to IC 6-1.1-15-3, your appeal to the State Board of Tax Commissioners is

3. Industrial

limited to the issues determined as a result of the County Property Tax Assessment

4. Commercial

Board of Appeals review.

Date Notification mailed (month, day, year)

Check type of property under appeal:

Real

Personal

SECTION I: PETITIONER INFORMATION

Name of property owner (Petitioner) (first, middle, last)

City

State

Address of property owner

ZIP code

Name of Authorized Representative

City

State

Address of Authorized Representative

ZIP code

SECTION II: DESCRIPTION OF PROPERTY

County

Township

Parcel or Key number (for real property)

Address of property

City

State

ZIP code

Legal description provided on Form 11 or Property Record Card (for real property), or business name (for personal property)

SECTION III: FINAL DETERMINATION

Effective date of assessed value

Assessed Value determined by County Property Tax Assessment Board of Appeals

Land:

Improvements:

Personal Property:

$

$

$

MARCH 1, __________________

You are hereby notified that the County Property Tax Assessment Board of Appeals has determined the assessed value of the property described on this

notification to be the value stated above as of March 1. THE COUNTY PROPERTY TAX BOARD OF APPEALS SHALL COMPLETE SECTION IV, V

AND VI OF THIS FORM. This notice shall be mailed to both the taxpayer and authorized representative. Copies of this determination shall be

forwarded to the County Assessor, Township Assessor, and County Auditor.

1

1 2

2 3

3