Reset Form

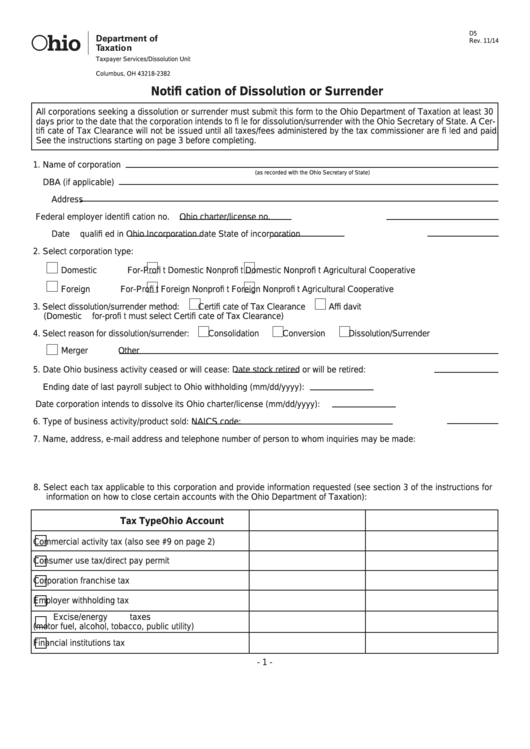

D5

Rev. 11/14

Taxpayer Services/Dissolution Unit

P.O. Box 182382

Columbus, OH 43218-2382

Notifi cation of Dissolution or Surrender

All corporations seeking a dissolution or surrender must submit this form to the Ohio Department of Taxation at least 30

days prior to the date that the corporation intends to fi le for dissolution/surrender with the Ohio Secretary of State. A Cer-

tifi cate of Tax Clearance will not be issued until all taxes/fees administered by the tax commissioner are fi led and paid.

See the instructions starting on page 3 before completing.

1. Name of corporation

(as recorded with the Ohio Secretary of State)

DBA (if applicable)

Address

Federal employer identifi cation no.

Ohio charter/license no.

Date qualifi ed in Ohio

Incorporation date

State of incorporation

2. Select corporation type:

Domestic For-Profi t

Domestic Nonprofi t

Domestic Nonprofi t Agricultural Cooperative

Foreign For-Profi t

Foreign Nonprofi t

Foreign Nonprofi t Agricultural Cooperative

3. Select dissolution/surrender method:

Certifi cate of Tax Clearance

Affi davit

(Domestic for-profi t must select Certifi cate of Tax Clearance)

4. Select reason for dissolution/surrender:

Consolidation

Conversion

Dissolution/Surrender

Merger Other

5. Date Ohio business activity ceased or will cease:

Date stock retired or will be retired:

Ending date of last payroll subject to Ohio withholding (mm/dd/yyyy):

Date corporation intends to dissolve its Ohio charter/license (mm/dd/yyyy):

6. Type of business activity/product sold:

NAICS code:

7. Name, address, e-mail address and telephone number of person to whom inquiries may be made:

8. Select each tax applicable to this corporation and provide information requested (see section 3 of the instructions for

information on how to close certain accounts with the Ohio Department of Taxation):

Tax Type

Ohio Account No.

Date Final Return Filed

Commercial activity tax (also see #9 on page 2)

Consumer use tax/direct pay permit

Corporation franchise tax

Employer withholding tax

Excise/energy taxes

(motor fuel, alcohol, tobacco, public utility)

Financial institutions tax

- 1 -

1

1 2

2 3

3 4

4