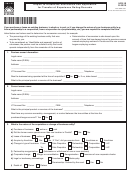

Form Uc-1 - Report To Determine Liability And If Liable Application For Employer Account Numeber Page 2

ADVERTISEMENT

12. NATURE AND PLACE OF BUSINESS (Indicate In Sections a,b,c,d, and e)

(a) City or Town

(b) County

(c) State

(d) Principal Types of Activity

Percent

(e) Principal Products or Services

Percent

(Manufacturer Word Furniture, Food Super Market,

Of

(leather Gloves, Electric Motors, TV

of

Truck Rental Etc.) EXPLAIN FULLY

Total

Repairs, etc)

EXPLAIN FULLY

Total

Total

100.00

Total

100.00

13. Will any employee work primarily in Delaware?

Yes

No

If yes, skip 13(a). Go to #14

If no, complete 13(a) before going to #14.

13(a) Will any employee perform some work in Delaware Yes

No

If yes, attach explanation. For each employee who does not work primarily in one state,

list all states where work is performed; list state where the base of operations is located;

list state from which work is directed; list employees state of residence

14 Name, title, addresses and telephones number of officer or representative to furnish payroll information.

15. Have you acquired the organization, trade or business or substantially all of the assets of another employing unit.

Yes

No

If yes, provide the name and Federal Identification Number of business purchased.

If yes do you wish to apply for a transfer of employment experience? Yes

No

If yes the Department will send you form UC-411 for you to complete and return.

16. If you have reorganized has the ownership and management remained substantially the same? Yes

No

THIS REPORT MUST BE SIGNED HERE BY THE OWNER OR DULY AUTHORIZED REPRESENTATIVE

It is hereby certified that the information in this report and in any

Attached sheets is true and correct, to the best of my knowledge, and is

Submitted with fully knowledge that there are penalties prescribed by

for misstatements . Application will not be processed without an

original signature.

(Original Signature

Required)

Title

Date

(Business Name)

NON PROFIT EMPLOYERS ONLY

15.

(a) Please submit the following documents:

(1) Copy of charter or articles o incorporation and by-laws

(2) Copy of Internal Revenue Status under IRS Code (Sec. 501-a)

(b) Do you have in your employer 4 or more employees"

Yes

No

(c) Do you elect the reimbursement method in lieu of paying assessments? Yes

No

If yes, the Department will send you form COM-4069

(d) Do you wish to make reimbursement payments with another employer and establish a group account? Yes

No

If answer is yes, list the names and addresses of all employers in the group and the name and address of the group

representative who will act as the agent responsible for the disbursement of timely payments to the State of Delaware.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2