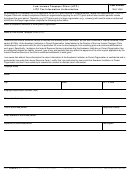

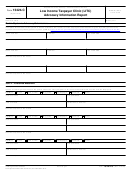

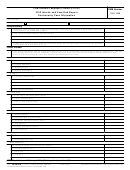

Form 13424-K - Low Income Taxpayer Clinics (Litcs) Interim And Year-End Report Controversy Case Information - 2012 Page 2

Download a blank fillable Form 13424-K - Low Income Taxpayer Clinics (Litcs) Interim And Year-End Report Controversy Case Information - 2012 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 13424-K - Low Income Taxpayer Clinics (Litcs) Interim And Year-End Report Controversy Case Information - 2012 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

ADVERTISEMENT

1

1 2

2 3

3 4

4 5

5