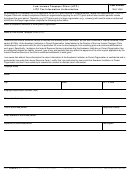

Instructions for Form 13424-K, Low Income Taxpayer Clinics (LITCs)

2012 Interim and Year-End Report Controversy Case Information

Note: Each controversy clinic must complete Form 13424-A, General Information, Form 13424-C, Advocacy Information,

Form 13424-K, Controversy Case Information, and Form 13424-B, Controversy Issues.

When submitting your Interim and Year-End Reports, include this form (Form 13424-K) as part of the Program Narrative. Interim

Report and Year-End Report requirements are described in Publication 3319, pages 71-74, and pages 75-77, respectively.

Note: Interim and Year-End Reports (including this report form) may be released under the Freedom of Information Act (FOIA). In

response to a FOIA request, the LITC Program Office will release these reports after appropriate redactions to ensure confidentiality of

taxpayer information.

Purpose

This form is used to report certain information about the worked performed by a clinic while representing taxpayers in controversy

cases.

The Program Office uses the information reported on this form and the other reporting forms to determine the scope of services

provided and the breadth of work done by clinics. Data is also aggregated to provide program-wide statistical information about

services provided to low income and English as a Second Language (ESL) taxpayers. Please be careful to follow the instructions for

this form and to report all information completely and accurately.

Reporting Requirements

Controversy. If your clinic has been funded to provide representation in controversy cases, complete all parts of this form.

Reporting Period. Clinics are required to report on clinic activities twice during the grant cycle. The grant cycle is January 1 through

December 31 for the year in which a grant award is received. An Interim Report is required to report activities conducted for the period

from January 1, 2012, through June 30, 2012; a Year-End Report is required to report activities conducted for the entire grant cycle,

the period from January 1 through December 31, 2012. Check the appropriate box at the beginning of the form indicating for which

period the report is being completed.

Definition of a controversy case

A controversy is a dispute between a taxpayer and the IRS concerning the amount or collection of federal tax liability. In order for a

client relationship to qualify as a controversy case, the services provided by the clinic must include advocacy and not merely fact

finding or advice. Matters involving fact finding or advice only are properly counted and reported as one-on-one consultations on Form

13424-A. If a taxpayer (or jointly filing taxpayers) has multiple years at issue and the different years are being handled by different IRS

units, this would be counted as a single case. Multiple tax issues arising from a single case may be properly reported on Form 13424-

B.

Specific Instructions

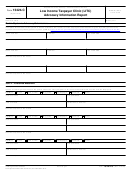

Case Inventory

Report on the volume of case inventory in this section.

Line 1A. Report on this line the number of controversy cases that were worked in the previous year that remained open as of January

1, 2012.

Line 1B. Report on this line the number of new controversy cases that were opened during the reporting period.

Line 1C. Report on this line the total number of controversy cases worked during the reporting period. The number reported on this

line should equal the total of lines 1A and 1B.

Line 1D. Report on this line the number of cases closed during the reporting period.

Line 1E. Report on this line the number of controversy cases that remained open at the end of the reporting period. The number

reported on this line is the result of line 1D subtracted from line 1C.

13424-K

Department of the Treasury - Internal Revenue Service

Form

(11-2011) Catalog Number 58507M

1

1 2

2 3

3 4

4 5

5