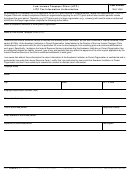

Instructions for Form 13424-K, Low Income Taxpayer Clinics (LITCs)

2012 Interim and Year-End Report Controversy Case Information

U.S. Tax Court Activities

Line 11. Check the appropriate box to indicate whether the clinic participates in the United States Tax Court Clinical Program. If the

box is checked indicating Yes, list the “place of trial” city or cities served.

Line 12. Report on this line the number of appearances entered to represent taxpayers in the United States Tax Court during the

reporting period, whether through an entry of appearance or via a petition submitted by the clinic.

Line 13. Report on this line the number of cases worked in the United States Tax Court during the reporting period, where

negotiations were conducted with the IRS on behalf of the taxpayer, but where no entry of appearance was submitted by the clinic. For

example, if a clinic staff attorney is representing a client in a tax controversy and the attorney negotiates a settlement with the IRS in

Tax Court but does not enter an appearance, it would be counted on Line 13.

Line 14. Report on this line the number of informal consultations conducted with taxpayers in the United States Tax Court during the

reporting period. Representation of taxpayers reported on line 13 should not be reported on this line. For example, if a clinic staff

member encounters a taxpayer at a United States Tax Court calendar call provides advice to the taxpayer but does not enter an

appearance, it would be counted on line 14.

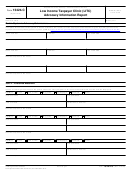

Closed Case Outcomes

Report in this section the outcomes of cases that were closed during the reporting period. Information reported in this section should

only relate to cases reported on line 1d. The information reported in this section will help the Program Office better understand the

impact of the clinic's controversy casework on taxpayers.

Line 15A. Report on this line the number of cases closed during the period in which the taxpayer was brought into filing compliance

during the representation.

Line 15B. Report on this line the number of cases closed during the period in which the taxpayer was brought into collection

compliance during the representation. Cases where the taxpayer is placed on an approved installment plan or where the taxpayer was

placed in currently not collectible status can be included here.

Line 15C. Report on this line the total dollars in tax refunds that were paid to taxpayers whose cases were closed during the reporting

period. Do not include refunded dollars that were offset against any other outstanding liability. This amount may include benefits that

were initially claimed after the start of the representation as well as benefits initially claimed by the taxpayer prior to representation but

that were only obtained after the representative overcame an IRS objection to the payment of such benefits.

Line 15D. Report on this line the total dollars in tax liabilities avoided by taxpayers whose cases were closed during the reporting

period. This amount may be calculated by subtracting the amount a taxpayer paid (or agreed to pay in an approved offer in

compromise) to resolve the controversy from the amount of tax proposed or assessed by the IRS (but not below zero).

13424-K

Department of the Treasury - Internal Revenue Service

Form

(11-2011) Catalog Number 58507M

1

1 2

2 3

3 4

4 5

5