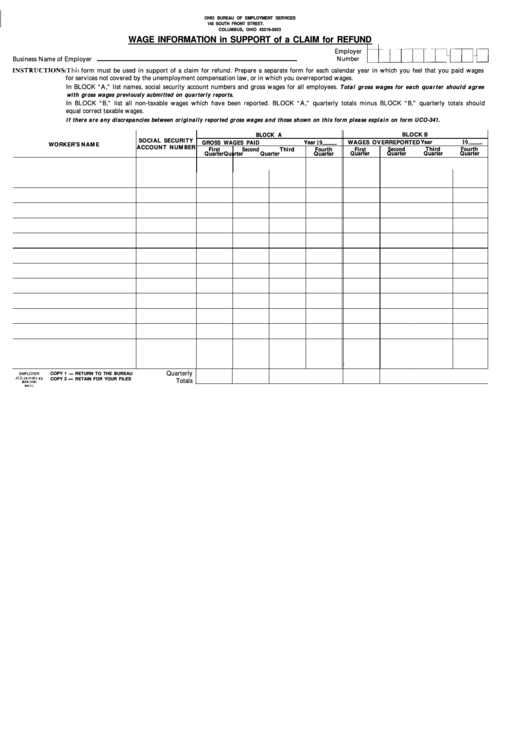

Form Uco-341a - Wage Information In Support Of A Claim For Refund

ADVERTISEMENT

1NSTRUCTIONS:This form must be used in support of a claim for refund. Prepare a separate form for each calendar year in which you feel that you paid wages

“CO-341A (R 5-W)

OHIO BUREAU OF EMPLOYMENT SERVICES

145 SOUTH FRONT STREET. P.O. BOX 923

COLUMBUS, OHIO 43216-0923

WAGE INFORMATION in SUPPORT of a CLAIM for REFUND

Employer

Number

Business Name of Employer

for services not covered by the unemployment compensation law, or in which you overreported wages.

In BLOCK “A,” list names, social security account numbers and gross wages for all employees.

Total gross wages for each quarter should agree

with gross wages previously submitted on quarterly reports.

In BLOCK “B,” list all non-taxable wages which have been reported. BLOCK “A,” quarterly totals minus BLOCK “B,” quarterly totals should

equal correct taxable wages.

If there are any discrepancies between originally reported gross wages and those shown on this form please explain on form UCO-341.

BLOCK B

BLOCK A

SOCIAL SECURITY

Year 19-

WAGES OVERREPORTED

Year 19-

GROSS WAGES PAID

WORKER’S NAME

ACCOUNT NUMBER

Third

Fourth

First

Second

Third

Fourth

First

Second

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarterly

EMPLOYER

COPY 1 - RETURN TO THE BUREAU

Totals

COPY 2 - RETAIN FOR YOUR FILES

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1