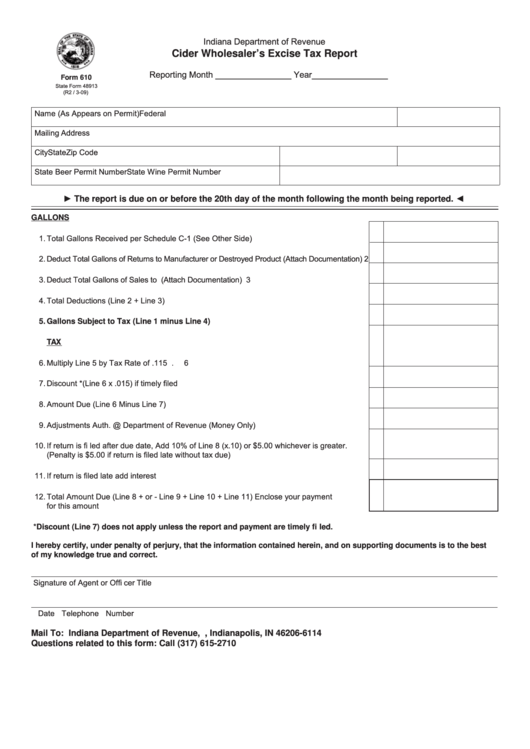

Indiana Department of Revenue

Cider Wholesaler’s Excise Tax Report

Reporting Month ________________ Year________________

Form 610

State Form 48913

(R2 / 3-09)

Name (As Appears on Permit)

Federal I.D. Number

Mailing Address

City

State

Zip Code

State Beer Permit Number

State Wine Permit Number

► The report is due on or before the 20th day of the month following the month being reported. ◄

GALLONS

1.

Total Gallons Received per Schedule C-1 (See Other Side).....................................................

1

2.

Deduct Total Gallons of Returns to Manufacturer or Destroyed Product (Attach Documentation)

2

3.

Deduct Total Gallons of Sales to U.S. Government Military Facilities (Attach Documentation)

3

4.

Total Deductions (Line 2 + Line 3) .............................................................................................

4

Gallons Subject to Tax (Line 1 minus Line 4) .......................................................................

5

5.

TAX

6.

Multiply Line 5 by Tax Rate of .115 ............................................................................................

6

7.

Discount *(Line 6 x .015) if timely fi led ......................................................................................

7

8.

Amount Due (Line 6 Minus Line 7) ............................................................................................

8

9.

Adjustments Auth. @ Department of Revenue (Money Only) ...................................................

9

10.

If return is fi led after due date, Add 10% of Line 8 (x.10) or $5.00 whichever is greater.

(Penalty is $5.00 if return is fi led late without tax due)............................................................... 10

11.

If return is fi led late add interest ................................................................................................ 11

12.

Total Amount Due (Line 8 + or - Line 9 + Line 10 + Line 11) Enclose your payment

for this amount .......................................................................................................................... 12

*Discount (Line 7) does not apply unless the report and payment are timely fi led.

I hereby certify, under penalty of perjury, that the information contained herein, and on supporting documents is to the best

of my knowledge true and correct.

Signature of Agent or Offi cer

Title

Date

Telephone Number

Mail To: Indiana Department of Revenue, P.O. Box 6114, Indianapolis, IN 46206-6114

Questions related to this form: Call (317) 615-2710

1

1 2

2