Form It-Qbr - Qualified Business Registration Form

ADVERTISEMENT

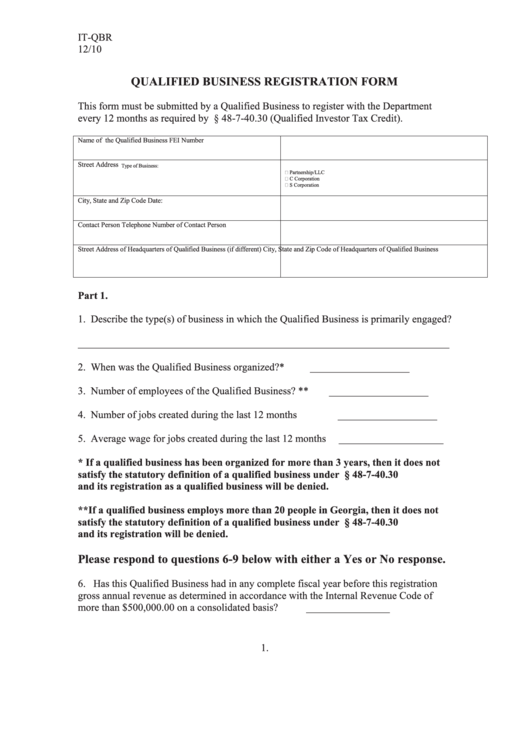

IT-QBR

12/10

QUALIFIED BUSINESS REGISTRATION FORM

This form must be submitted by a Qualified Business to register with the Department

every 12 months as required by O.C.G.A. § 48-7-40.30 (Qualified Investor Tax Credit).

Name of the Qualified Business

FEI Number

Street Address

Type of Business:

Partnership/LLC

C Corporation

S Corporation

City, State and Zip Code

Date:

Contact Person

Telephone Number of Contact Person

Street Address of Headquarters of Qualified Business (if different)

City, State and Zip Code of Headquarters of Qualified Business

Part 1.

1. Describe the type(s) of business in which the Qualified Business is primarily engaged?

_______________________________________________________________________

2. When was the Qualified Business organized?*

___________________

3. Number of employees of the Qualified Business? **

___________________

4. Number of jobs created during the last 12 months

___________________

5. Average wage for jobs created during the last 12 months

____________________

* If a qualified business has been organized for more than 3 years, then it does not

satisfy the statutory definition of a qualified business under O.C.G.A. § 48-7-40.30

and its registration as a qualified business will be denied.

**If a qualified business employs more than 20 people in Georgia, then it does not

satisfy the statutory definition of a qualified business under O.C.G.A. § 48-7-40.30

and its registration will be denied.

Please respond to questions 6-9 below with either a Yes or No response.

6. Has this Qualified Business had in any complete fiscal year before this registration

gross annual revenue as determined in accordance with the Internal Revenue Code of

more than $500,000.00 on a consolidated basis?

________________

1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3