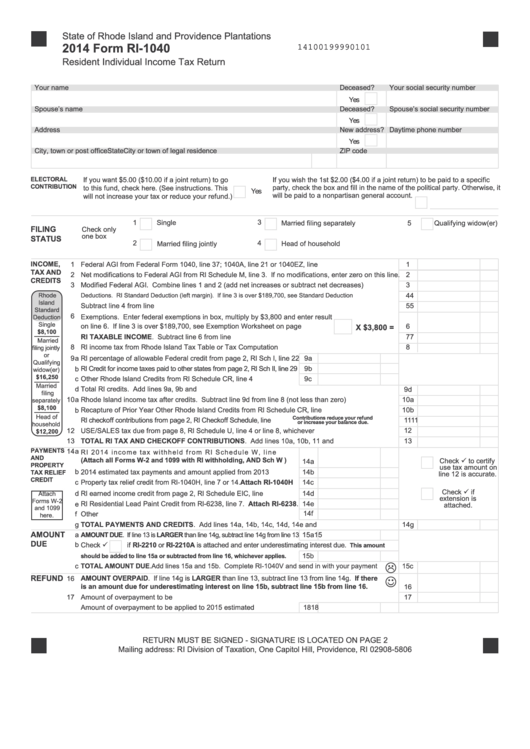

State of Rhode Island and Providence Plantations

2014 Form RI-1040

14100199990101

Resident Individual Income Tax Return

Your name

Deceased?

Your social security number

Yes

Spouse’s name

Deceased?

Spouse’s social security number

Yes

Address

New address?

Daytime phone number

Yes

City, town or post office

State

ZIP code

City or town of legal residence

ELECTORAL

If you want $5.00 ($10.00 if a joint return) to go

If you wish the 1st $2.00 ($4.00 if a joint return) to be paid to a specific

CONTRIBUTION

party, check the box and fill in the name of the political party. Otherwise, it

to this fund, check here. (See instructions. This

Yes

will be paid to a nonpartisan general account.

will not increase your tax or reduce your refund.)

1

Single

3

Married filing separately

5

Qualifying widow(er)

FILING

Check only

one box

STATUS

2

4

Married filing jointly

Head of household

INCOME,

1

Federal AGI from Federal Form 1040, line 37; 1040A, line 21 or 1040EZ, line 4........................................

1

TAX AND

2

Net modifications to Federal AGI from RI Schedule M, line 3. If no modifications, enter zero on this line.

2

CREDITS

3

Modified Federal AGI. Combine lines 1 and 2 (add net increases or subtract net decreases)...................

3

4

4

Rhode

Deductions. RI Standard Deduction (left margin). If line 3 is over $189,700, see Standard Deduction Worksheet..........

Island

5

Subtract line 4 from line 3............................................................................................................................

5

Standard

6

Exemptions. Enter federal exemptions in box, multiply by $3,800 and enter result

Deduction

Single

on line 6. If line 3 is over $189,700, see Exemption Worksheet on page i..............

6

X $3,800 =

$8,100

7

RI TAXABLE INCOME. Subtract line 6 from line 5....................................................................................

7

Married

8

RI income tax from Rhode Island Tax Table or Tax Computation Worksheet..............................................

8

filing jointly

or

9

a

RI percentage of allowable Federal credit from page 2, RI Sch I, line 22

9a

Qualifying

b

RI Credit for income taxes paid to other states from page 2, RI Sch II, line 29

9b

widow(er)

$16,250

c

Other Rhode Island Credits from RI Schedule CR, line 4 .......................

9c

Married

d

Total RI credits. Add lines 9a, 9b and 9c....................................................................................................

9d

filing

10

a

Rhode Island income tax after credits. Subtract line 9d from line 8 (not less than zero)............................

10a

separately

$8,100

Recapture of Prior Year Other Rhode Island Credits from RI Schedule CR, line 7.....................................

10b

b

Head of

Contributions reduce your refund

11

RI checkoff contributions from page 2, RI Checkoff Schedule, line 37.......

.............. 11

or increase your balance due.

household

12

USE/SALES tax due from page 8, RI Schedule U, line 4 or line 8, whichever applies...............................

12

$12,200

13

TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS. Add lines 10a, 10b, 11 and 12.............................

13

PAYMENTS

14

R I 2 01 4 i nc o me ta x wi th h el d fr om RI S che d u le W, l ine 16....

AND

Check ü to certify

(Attach all Forms W-2 and 1099 with RI withholding, AND Sch W )

14a

PROPERTY

use tax amount on

b

2014 estimated tax payments and amount applied from 2013 return.....

14b

TAX RELIEF

line 12 is accurate.

CREDIT

Property tax relief credit from RI-1040H, line 7 or 14. Attach RI-1040H

14c

Check ü if

d

RI earned income credit from page 2, RI Schedule EIC, line 46............. 14d

Attach

extension is

Forms W-2

e

RI Residential Lead Paint Credit from RI-6238, line 7. Attach RI-6238. 14e

attached.

and 1099

14f

f

Other payments.......................................................................................

here.

g

TOTAL PAYMENTS AND CREDITS. Add lines 14a, 14b, 14c, 14d, 14e and 14f..................................... 14g

AMOUNT

15

a

AMOUNT DUE. If line 13 is LARGER than line 14g, subtract line 14g from line 13 15a

DUE

Check ü

b

if RI-2210 or RI-2210A is attached and enter underestimating interest due.

This amount

should be added to line 15a or subtracted from line 16, whichever applies.

15b

L

c

TOTAL AMOUNT DUE. Add lines 15a and 15b. Complete RI-1040V and send in with your payment

15c

☺

REFUND

AMOUNT OVERPAID. If line 14g is LARGER than line 13, subtract line 13 from line 14g. If there

16

is an amount due for underestimating interest on line 15b, subtract line 15b from line 16.

16

17

Amount of overpayment to be refunded......................................................................................................

17

18

Amount of overpayment to be applied to 2015 estimated tax.................

18

RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

1

1 2

2