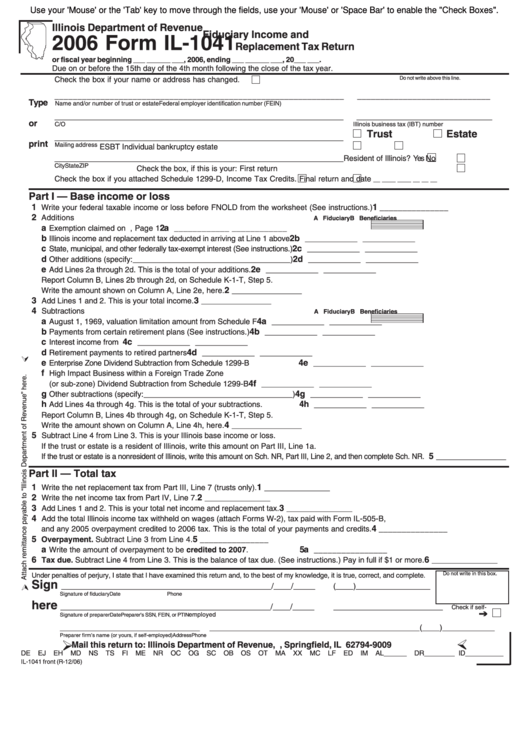

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Fiduciary Income and

2006 Form IL-1041

Replacement Tax Return

or fiscal year beginning ___ ______ ___, 2006, ending ___ ______ ___, 20___ ___.

Due on or before the 15th day of the 4th month following the close of the tax year.

Do not write above this line.

Check the box if your name or address has changed.

_______________________________________________________________

_____________________________

Type

Name and/or number of trust or estate

Federal employer identification number (FEIN)

__________________________________________________________________

_______________________________

or

C/O

Illinois business tax (IBT) number

Trust

Estate

__________________________________________________________________

print

Mailing address

ESBT

Individual bankruptcy estate

__________________________________________________________________

Resident of Illinois?

Yes

No

City

State

ZIP

Check the box, if this is your:

First return

Check the box if you attached Schedule 1299-D, Income Tax Credits.

Final return and date

__ ____ ____ __ __ __

Part I — Base income or loss

1

1

Write your federal taxable income or loss before FNOLD from the worksheet (See instructions.)

_______________

2

Additions

A Fiduciary

B Beneficiaries

a

2a

Exemption claimed on U.S. Form 1041, Page 1

____________ ____________

b

2b

Illinois income and replacement tax deducted in arriving at Line 1 above

____________ ____________

c

2c

State, municipal, and other federally tax-exempt interest (See instructions.)

____________ ____________

d

2d

Other additions (specify:____________________________________)

____________ ____________

e

2e

Add Lines 2a through 2d. This is the total of your additions.

____________ ____________

Report Column B, Lines 2b through 2d, on Schedule K-1-T, Step 5.

2

Write the amount shown on Column A, Line 2e, here.

________________

3

3

Add Lines 1 and 2. This is your total income.

________________

4

Subtractions

A Fiduciary

B Beneficiaries

a

4a

August 1, 1969, valuation limitation amount from Schedule F

____________ ____________

b

4b

Payments from certain retirement plans (See instructions.)

____________ ____________

c

4c

Interest income from U.S. Treasury and other exempt federal obligations

____________ ____________

d

4d

Retirement payments to retired partners

____________ ____________

e

4e

Enterprise Zone Dividend Subtraction from Schedule 1299-B

____________ ____________

f

High Impact Business within a Foreign Trade Zone

4f

(or sub-zone) Dividend Subtraction from Schedule 1299-B

____________ ____________

g

4g

Other subtractions (specify:__________________________________)

____________ ____________

h

4h

Add Lines 4a through 4g. This is the total of your subtractions.

____________ ____________

Report Column B, Lines 4b through 4g, on Schedule K-1-T, Step 5.

4

Write the amount shown on Column A, Line 4h, here.

________________

5

Subtract Line 4 from Line 3. This is your Illinois base income or loss.

If the trust or estate is a resident of Illinois, write this amount on Part III, Line 1a.

5

If the trust or estate is a nonresident of Illinois, write this amount on Sch. NR, Part III, Line 2, and then complete Sch. NR.

________________

Part II — Total tax

1

1

Write the net replacement tax from Part III, Line 7 (trusts only).

_______________

2

2

Write the net income tax from Part IV, Line 7.

_______________

3

3

Add Lines 1 and 2. This is your total net income and replacement tax.

_______________

4

Add the total Illinois income tax withheld on wages (attach Forms W-2), tax paid with Form IL-505-B,

4

and any 2005 overpayment credited to 2006 tax. This is the total of your payments and credits.

_______________

5

5

Overpayment. Subtract Line 3 from Line 4.

_______________

a

5a

Write the amount of overpayment to be credited to 2007.

________________

6

6

Tax due. Subtract Line 4 from Line 3. This is the balance of tax due. (See instructions.) Pay in full if $1 or more.

_______________

Do not write in this box.

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign

________________________________________________/____/_____

(____)_________________

Signature of fiduciary

Date

Phone

here

________________________________________________/____/_____

_________________________

Check if self-

employed

Signature of preparer

Date

Preparer’s SSN, FEIN, or PTIN

________________________________

________________________________________________

(____)____________

Preparer firm’s name (or yours, if self-employed)

Address

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19009, Springfield, IL 62794-9009

DE

EJ

EH

MD

NS

TS

FI

ME

NR

OC

OG

SC

OB

OS

OT

MA

XX

MC

LF

ED

IM

AL______

DR________ ID__________

IL-1041 front (R-12/06)

1

1 2

2