Instructions For Schedule K-1vt

ADVERTISEMENT

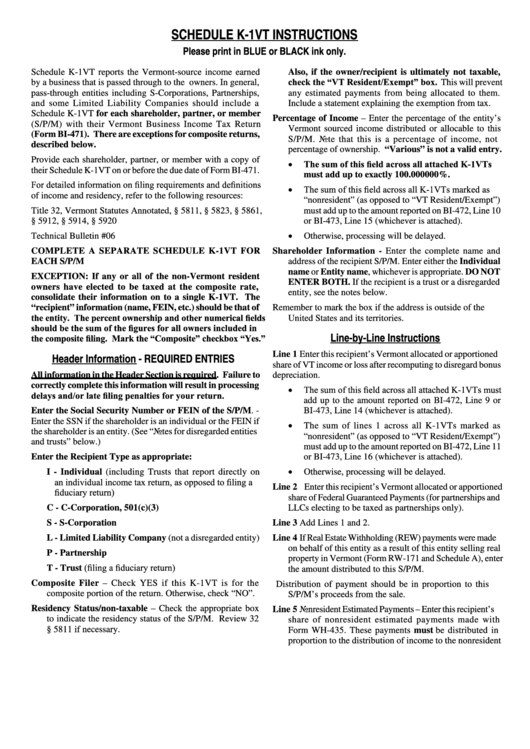

SCHEDULE K-1VT INSTRUCTIONS

Please print in BLUE or BLACK ink only.

Schedule K-1VT reports the Vermont-source income earned

Also, if the owner/recipient is ultimately not taxable,

check the “VT Resident/Exempt” box. This will prevent

by a business that is passed through to the owners. In general,

pass-through entities including S-Corporations, Partnerships,

any estimated payments from being allocated to them.

and some Limited Liability Companies should include a

Include a statement explaining the exemption from tax.

Schedule K-1VT for each shareholder, partner, or member

Percentage of Income – Enter the percentage of the entity’s

(S/P/M) with their Vermont Business Income Tax Return

Vermont sourced income distributed or allocable to this

(Form BI-471). There are exceptions for composite returns,

S/P/M. Note that this is a percentage of income, not

described below.

percentage of ownership. “Various” is not a valid entry.

Provide each shareholder, partner, or member with a copy of

• The sum of this field across all attached K-1VTs

their Schedule K-1VT on or before the due date of Form BI-471.

must add up to exactly 100.000000%.

For detailed information on filing requirements and definitions

• The sum of this field across all K-1VTs marked as

of income and residency, refer to the following resources:

“nonresident” (as opposed to “VT Resident/Exempt”)

Title 32, Vermont Statutes Annotated, § 5811, § 5823, § 5861,

must add up to the amount reported on BI-472, Line 10

§ 5912, § 5914, § 5920

or BI-473, Line 15 (whichever is attached).

• Otherwise, processing will be delayed.

Technical Bulletin #06

COMPLETE A SEPARATE SCHEDULE K-1VT FOR

Shareholder Information - Enter the complete name and

EACH S/P/M

address of the recipient S/P/M. Enter either the Individual

name or Entity name, whichever is appropriate. DO NOT

EXCEPTION: If any or all of the non-Vermont resident

ENTER BOTH. If the recipient is a trust or a disregarded

owners have elected to be taxed at the composite rate,

entity, see the notes below.

consolidate their information on to a single K-1VT. The

“recipient” information (name, FEIN, etc.) should be that of

Remember to mark the box if the address is outside of the

the entity. The percent ownership and other numerical fields

United States and its territories.

should be the sum of the figures for all owners included in

Line-by-Line Instructions

the composite filing. Mark the “Composite” checkbox “Yes.”

Header Information - REQUIRED ENTRIES

Line 1 Enter this recipient’s Vermont allocated or apportioned

share of VT income or loss after recomputing to disregard bonus

All information in the Header Section is required. Failure to

depreciation.

correctly complete this information will result in processing

• The sum of this field across all attached K-1VTs must

delays and/or late filing penalties for your return.

add up to the amount reported on BI-472, Line 9 or

Enter the Social Security Number or FEIN of the S/P/M. -

BI-473, Line 14 (whichever is attached).

Enter the SSN if the shareholder is an individual or the FEIN if

• The sum of lines 1 across all K-1VTs marked as

the shareholder is an entity. (See “Notes for disregarded entities

“nonresident” (as opposed to “VT Resident/Exempt”)

and trusts” below.)

must add up to the amount reported on BI-472, Line 11

Enter the Recipient Type as appropriate:

or BI-473, Line 16 (whichever is attached).

• Otherwise, processing will be delayed.

I - Individual (including Trusts that report directly on

an individual income tax return, as opposed to filing a

Line 2 Enter this recipient’s Vermont allocated or apportioned

fiduciary return)

share of Federal Guaranteed Payments (for partnerships and

C - C-Corporation, 501(c)(3)

LLCs electing to be taxed as partnerships only).

S - S-Corporation

Line 3 Add Lines 1 and 2.

L - Limited Liability Company (not a disregarded entity)

Line 4 If Real Estate Withholding (REW) payments were made

on behalf of this entity as a result of this entity selling real

P - Partnership

property in Vermont (Form RW-171 and Schedule A), enter

T - Trust (filing a fiduciary return)

the amount distributed to this S/P/M.

Composite Filer – Check YES if this K-1VT is for the

Distribution of payment should be in proportion to this

composite portion of the return. Otherwise, check “NO”.

S/P/M’s proceeds from the sale.

Residency Status/non-taxable – Check the appropriate box

Line 5 Nonresident Estimated Payments – Enter this recipient’s

to indicate the residency status of the S/P/M. Review 32

share of nonresident estimated payments made with

V.S.A. § 5811 if necessary.

Form WH-435. These payments must be distributed in

proportion to the distribution of income to the nonresident

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2