Instructions for Completing Form 160, Combined Return for Michigan Taxes

Monthly/Quarterly: Check whether you are monthly or

IMPORTANT: This return MUST be completed online. After

quarterly filer. You must make a selection before continuing.

completing, you must use the PRINT button on the return to print

the return for mailing. Do NOT print and complete by hand.

Account Number: Enter your assigned 9-digit federal

employer identification number (FEIN) or Michigan Treasury

If you registered your business with the Michigan Department of

number. If you do not have an account number, see "Business

Treasury, you were mailed pre-identified returns and vouchers

Registration."

containing specific information about your account. This

monthly/quarterly Form 160, Combined Return for Michigan

Return Period: Select the appropriate return period from the

Taxes, is intended for registered businesses that have not yet

drop down lists.

received their return booklet or that have lost or misplaced their

returns. To assist in timely and accurate postings, please continue

Due Date: The return and payment are due on or before the

to use the pre-identified returns mailed to you if available.

20th of the month following the tax period (month or quarter).

If the 20th falls on a holiday or weekend, the due date is the

Choose to eliminate paper filing requirements by registering for

first business day following the weekend or holiday.

electronic funds transfer (EFT). For information on EFT

registration and filing, visit

Tax Due: Enter the tax due amount(s) in the space provided

next to the appropriate tax(es) you are paying. Enter the total

Business Registration

of all taxes due on the Total Payment line.

If you are a new business, visit Treasury's Web site at

A complete business

Credits: For a period in which you have a credit, enter zero on

registration booklet

is available to help you determine the taxes

the Total Payment line of the return. Carry the credit forward

for which you must register. If you need assistance, contact the

on your

worksheets

for each period until you have an amount

Registration Unit at 517-636-6925 or email your questions to

due. Do not enter a credit on this return (scanning equipment

treasreg@michigan.gov. You will be mailed pre-identified

reads all entries as debits/money owed).

returns and vouchers containing specific information about your

account. If you lose your returns and vouchers, contact the

Late or Insufficient Payments

Registration Unit to have new forms mailed to you. You may use

Returns filed late or without payment of tax due are subject to

the return below until you receive your pre-identified returns in

both penalty and interest. Treasury's

Penalty and Interest

the mail. Returns and vouchers pre-identified for the filing

Calculator

may be used to assist in computing any additional

periods remitted using the Web form should be discarded from

fees.

the return booklet you receive.

When You Are Finished

Completing the Return

After completing the return, print the form using the PRINT

Complete only one form and write a single check for the total

button on the return. Detach the return from the instructions by

sales, use, and withholding and Corporate Income taxes due. You

cutting along the dotted line below. Mail your return and

are required to file even if no tax is due (indicate zero tax due on

payment to the address on the return. Make your check payable

your return). Find

instructions

and

worksheets

for completing

to "State of Michigan."

Form 160 on Treasury's Web site.

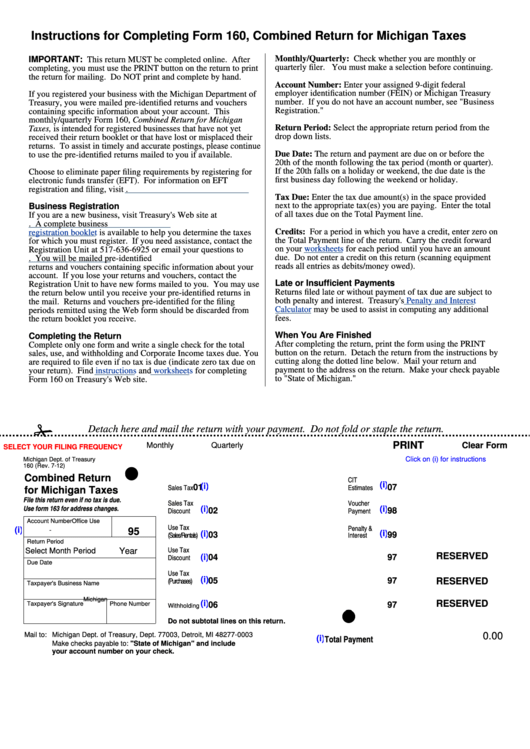

Detach here and mail the return with your payment. Do not fold or staple the return.

PRINT

Clear Form

Monthly

Quarterly

SELECT YOUR FILING FREQUENCY

Click on (i) for instructions

Michigan Dept. of Treasury

160 (Rev. 7-12)

Combined Return

CIT

(i)

(i)

Sales Tax

01

Estimates

07

for Michigan Taxes

File this return even if no tax is due.

Sales Tax

Voucher

Use form 163 for address changes.

(i)

(i)

Discount

02

Payment

98

Account Number

Office Use

Use Tax

Penalty &

(i)

-

95

(i)

(i)

(Sales/Rentals)

Interest

03

99

Return Period

Use Tax

Select Month Period

Year

RESERVED

(i)

Discount

04

97

Due Date

Use Tax

(i)

(Purchases)

05

97

RESERVED

Taxpayer's Business Name

Michigan

(i)

RESERVED

Taxpayer's Signature

Phone Number

06

97

Withholding

Do not subtotal lines on this return.

0.00

Mail to:

Michigan Dept. of Treasury, Dept. 77003, Detroit, MI 48277-0003

Total Payment

(i)

Make checks payable to: "State of Michigan" and include

your account number on your check.

1

1