INSTRUCTIONS

RECORDS

WHO MUST FILE THIS REPORT

You must keep a copy of your report and all records

The Wisconsin Limited Manufacturer’s Permit issued

pertaining to your alcohol inventories and usage for

allows the holder to manufacture ethyl alcohol for

a minimum of four years.

use as fuel. If the alcohol is used in a licensed motor

vehicle, the Wisconsin motor vehicle fuel tax is due

WHERE TO FILE YOUR REPORT

on the alcohol placed into the licensed motor vehicle.

Mail your completed report to the mailing address

PERIOD COVERED BY REPORT

listed in these instructions.

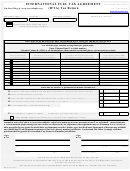

Use this form to compute the Wisconsin motor vehicle

COMPLETING REPORT

fuel tax due on the alcohol placed in licensed motor

vehicles from July 1, of one year, through June 30,

Line 1. Enter the actual measured gallons of ethyl

of the following year. This report must be filed even

alcohol in your possession at the beginning of the

if no tax is due.

period. Enter alcohol gallons and not gallons of

gasohol. Alcohol must be reported in U.S. standard

liquid gallons (231 cubic inches).

DUE DATE

This report is due on or before July 31 of each year.

Line 4. Enter the number of gallons of alcohol used

To be timely filed, the report must be postmarked on

or added to gasoline (gasohol) and placed in licensed

or before its due date and received within five days

motor vehicles during each period.

of the due date.

Line 5. Enter the number of gallons of ethyl alcohol

Late filed reports are subject to statutory late-filing

disposed of for other purposes during these periods

fees, penalties, and interest.

(for example, heating fuels, farm tractor fuel, spillage).

Enter alcohol gallons and not gallons of gasohol on

ASSISTANCE

this line.

You can access the department’s web site at

From this web site, you can:

Line 8. Enter the actual measured gallons of ethyl

alcohol in your possession at the end of each period.

• Complete electronic fill-in forms

If you are unable to measure the alcohol in your stor-

• Download forms, schedules, instructions, and

age facilities, estimate the gallons. Enter alcohol

publications

gallons and not gasohol gallons on this line.

• View answers to frequently asked questions

• E-mail for assistance

Sign and date the report and indicate the business

• Access to My Tax Account

telephone number.

Madison Office Location

PAYMENT

2135 Rimrock Road

Make checks payable to Wisconsin Department of

Madison, WI 53713

Revenue. Write the Limited Manufacturer’s Permit

number on the check or money order.

Mailing Address

Excise Tax Section 6-107

Annual tax liabilities of $1,000 or more are to be paid

Wisconsin Department of Revenue

by Electronic Funds Transfer (EFT). Call (608) 266-

PO Box 8900

0064 for information about paying tax by EFT.

Madison WI 53708-8900

Phone: (608) 266-3223 or (608) 266-0064

Fax: (608) 261-7049

E-mail: excise@revenue.wi.gov

1

1 2

2