Home And Community Care Program In Western Australia - Giude To The Unit Costs Spreadsheet - 2012 Page 10

ADVERTISEMENT

Guide to the Unit Costs Spreadsheet

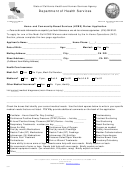

3.4 Costs Worksheet

Enter your expenses in the Costs worksheet.

Note that the percentage (%) of the Wage Cost in Each Service Type is calculated using the

data supplied in the Hours sheet and is used to apportion costs across service types.

Expenses

Expenses are split up into the following categories:

Cat 1 Direct Employee Costs - Salaries and Wages Costs are automatically calculated

based on information entered in the Hours sheet

Cat 2 Direct Travel (i.e. in delivery of services)

Cat 3 Materials (in delivery of services)

Cat 4 Direct Purchased Services (e.g. sub-contracted services)

Cat 5 Indirect Time Costs (backup costs to service delivery, e.g. rosters, training,

progress notes)

Cat 6 Management & Admin Employee Costs (manager, accounting, quality, reception)

Cat 7 Accommodation

Cat 8 Other Service Costs

Cat 9 Overhead Allocation (administration costs incurred by head office or sponsor

organisation). Note: do not include capital expenditure, i.e. HACC capital grant

purchases.

A full definition of each category is provided in the Cost Cats worksheet.

Figure 5: Costs Sheet

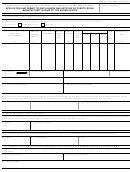

A Note on Meals on Wheels

(MOW):

It is useful to calculate the

cost of MOW but keep in mind

that HACC funds the delivery

component only and will

disallow any other expenses.

Whatever the difference is

between the unit price and

cost, it should be recouped

from the client. HACC

considers meals a cost of

daily living.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15