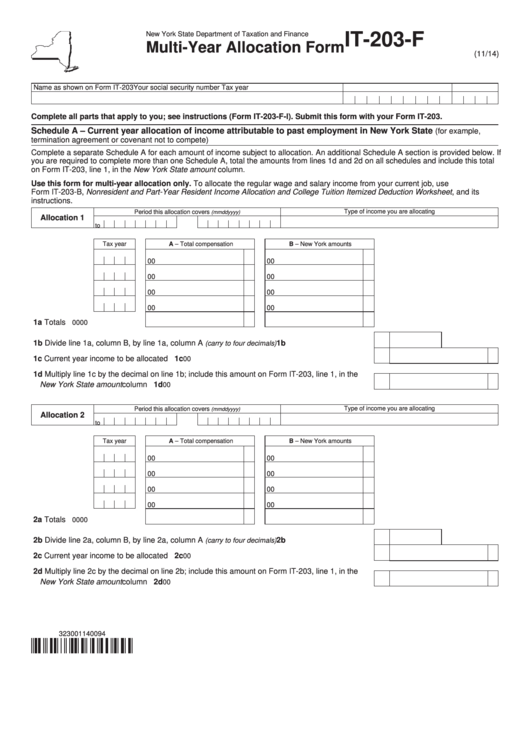

New York State Department of Taxation and Finance

IT-203-F

Multi-Year Allocation Form

(11/14)

Name as shown on Form IT-203

Your social security number

Tax year

Complete all parts that apply to you; see instructions (Form IT-203-F-I). Submit this form with your Form IT-203.

Schedule A – Current year allocation of income attributable to past employment in New York State

(for example,

termination agreement or covenant not to compete)

Complete a separate Schedule A for each amount of income subject to allocation. An additional Schedule A section is provided below. If

you are required to complete more than one Schedule A, total the amounts from lines 1d and 2d on all schedules and include this total

on Form IT-203, line 1, in the New York State amount column.

Use this form for multi-year allocation only. To allocate the regular wage and salary income from your current job, use

Form IT-203-B, Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet, and its

instructions.

Type of income you are allocating

Period this allocation covers

(mmddyyyy)

Allocation 1

to

Tax year

A – Total compensation

B – New York amounts

00

00

00

00

00

00

00

00

1a Totals .................................

00

00

1b Divide line 1a, column B, by line 1a, column A

.......................................... 1b

(carry to four decimals)

1c Current year income to be allocated ........................................................................................... 1c

00

1d Multiply line 1c by the decimal on line 1b; include this amount on Form IT-203, line 1, in the

New York State amount column .............................................................................................. 1d

00

Type of income you are allocating

Period this allocation covers

(mmddyyyy)

Allocation 2

to

Tax year

A – Total compensation

B – New York amounts

00

00

00

00

00

00

00

00

2a Totals .................................

00

00

2b Divide line 2a, column B, by line 2a, column A

.......................................... 2b

(carry to four decimals)

2c Current year income to be allocated ........................................................................................... 2c

00

2d Multiply line 2c by the decimal on line 2b; include this amount on Form IT-203, line 1, in the

New York State amount column .............................................................................................. 2d

00

323001140094

1

1 2

2