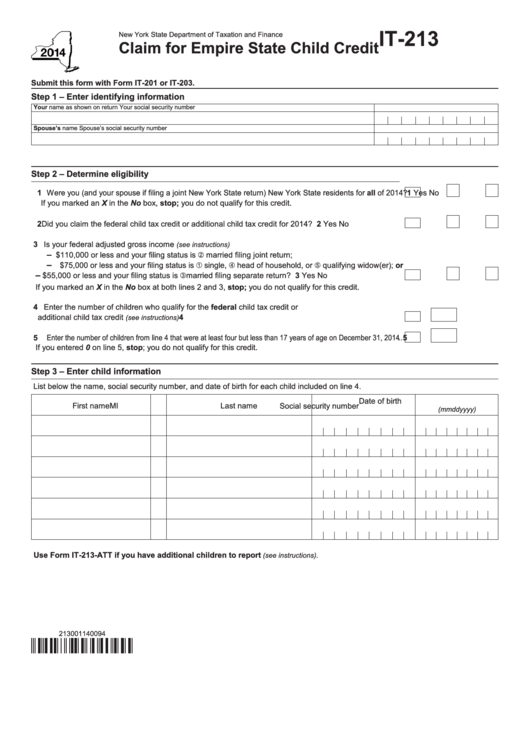

IT-213

New York State Department of Taxation and Finance

Claim for Empire State Child Credit

Submit this form with Form IT-201 or IT-203.

Step 1 – Enter identifying information

Your name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Step 2 – Determine eligibility

1 Were you (and your spouse if filing a joint New York State return) New York State residents for all of 2014?

1

Yes

No

If you marked an X in the No box, stop; you do not qualify for this credit.

2 Did you claim the federal child tax credit or additional child tax credit for 2014? .......................................

2

Yes

No

3 Is your federal adjusted gross income

(see instructions)

–

$110,000 or less and your filing status is married filing joint return;

–

$75,000 or less and your filing status is single, head of household, or qualifying widow(er); or

–

$55,000 or less and your filing status is married filing separate return? ..........................................

3

Yes

No

If you marked an X in the No box at both lines 2 and 3, stop; you do not qualify for this credit.

4 Enter the number of children who qualify for the federal child tax credit or

additional child tax credit

...............................................................................................

4

(see instructions)

5 Enter the number of children from line 4 that were at least four but less than 17 years of age on December 31, 2014 ..

5

If you entered 0 on line 5, stop; you do not qualify for this credit.

Step 3 – Enter child information

List below the name, social security number, and date of birth for each child included on line 4.

Date of birth

First name

MI

Last name

Social security number

(mmddyyyy)

Use Form IT-213-ATT if you have additional children to report

(see instructions).

213001140094

1

1 2

2