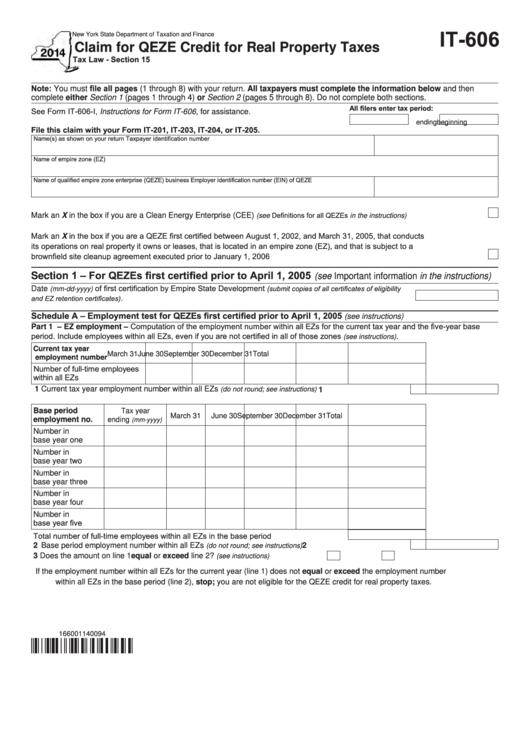

IT-606

New York State Department of Taxation and Finance

Claim for QEZE Credit for Real Property Taxes

Tax Law - Section 15

Note: You must file all pages (1 through 8) with your return. All taxpayers must complete the information below and then

complete either Section 1 (pages 1 through 4) or Section 2 (pages 5 through 8). Do not complete both sections.

All filers enter tax period:

See Form IT-606-I, Instructions for Form IT-606, for assistance.

beginning

ending

File this claim with your Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on your return

Taxpayer identification number

Name of empire zone (EZ)

Name of qualified empire zone enterprise (QEZE) business

Employer identification number (EIN) of QEZE

Mark an X in the box if you are a Clean Energy Enterprise (CEE)

....................................

(see Definitions for all QEZEs in the instructions)

Mark an X in the box if you are a QEZE first certified between August 1, 2002, and March 31, 2005, that conducts

its operations on real property it owns or leases, that is located in an empire zone (EZ), and that is subject to a

brownfield site cleanup agreement executed prior to January 1, 2006 ..................................................................................................

Section 1 – For QEZEs first certified prior to April 1, 2005

(see Important information in the instructions)

Date

of first certification by Empire State Development

(submit copies of all certificates of eligibility

(mm-dd-yyyy)

. .....................................................................................................................................

and EZ retention certificates)

Schedule A – Employment test for QEZEs first certified prior to April 1, 2005

(see instructions)

Part 1 – EZ employment – Computation of the employment number within all EZs for the current tax year and the five-year base

period. Include employees within all EZs, even if you are not certified in all of those zones

.

(see instructions)

Current tax year

March 31

June 30

September 30 December 31

Total

employment number

Number of full-time employees

within all EZs

1 Current tax year employment number within all EZs

.......................................

(do not round; see instructions)

1

Tax year

Base period

March 31

June 30

September 30 December 31

Total

ending

employment no.

(mm-yyyy)

Number in

base year one

Number in

base year two

Number in

base year three

Number in

base year four

Number in

base year five

Total number of full-time employees within all EZs in the base period ..................................

2 Base period employment number within all EZs

..............................................

2

(do not round; see instructions)

3 Does the amount on line 1 equal or exceed line 2?

............. Yes

No

(see instructions)

If the employment number within all EZs for the current year (line 1) does not equal or exceed the employment number

within all EZs in the base period (line 2), stop; you are not eligible for the QEZE credit for real property taxes.

166001140094

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8