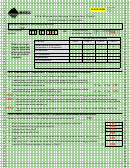

IT-636 (2014) (back)

Schedule C – Partnership, S corporation, estate, and trust information

(see instructions)

If you were a partner in a partnership, a shareholder of a New York S corporation, or a beneficiary of an estate or trust and received a share of the

beer production credit from that entity, complete the following information for each partnership, New York S corporation, estate or trust. For Type,

enter P for partnership, S for S corporation, or ET for estate or trust.

Name of entity

Type

Employer identification number

Schedule D – Partner’s, shareholder’s, or beneficiary’s share of credit

(see instructions)

Partner

11 Enter your share of credit from your partnership ............................................

.

11

00

S corporation

shareholder

12 Enter your share of credit from your S corporation .........................................

12

.

00

Beneficiary

13 Enter your share of credit from the estate or trust ............................................

.

13

00

.

14 Total

...........................................................................

(add lines 11, 12, and 13)

14

00

Fiduciaries: Include the line 14 amount in the Total line of Schedule E, column C.

All others: Enter the line 14 amount on line 16.

Schedule E – Beneficiary’s and fiduciary’s share of credit

(see instructions)

A

B

C

Beneficiary’s name

Identifying number

Share of credit

(same as on Form IT-205, Schedule C)

(fiduciaries, enter the amount from line 10 plus the amount from line 14)

Total

.

00

.

00

.

00

Fiduciary

.

00

Schedule F – Computation of credit

(see instructions)

Individuals and partnerships 15 Enter the amount from line 10 ................................................. 15

.

00

Partners, S corporation

shareholders, beneficiaries

16 Enter the amount from line 14 ................................................. 16

.

00

Fiduciaries

.

17 Enter the amount from Schedule E, column C, Fiduciary line .. 17

00

.

18 Total credit

........................................ 18

(add lines 15, 16, and 17)

00

636002140094

1

1 2

2