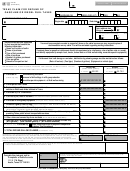

Form 06-106 (Back)(Rev.8-09/19)

INSTRUCTIONS FOR COMPLETING TEXAS CLAIM FOR

REFUND OF GASOLINE OR DIESEL FUEL TAXES

NOTE: If you are filing a claim for both gasoline and diesel fuel tax refund for the same period, you may file both claims on one form.

The amount of your gasoline and/or diesel fuel claims will be paid less deductions of 2% of the gallonage claimed.

You must keep complete records to support all items on the claim because we may request copies of documentation on any

claim. You will be contacted regarding mailing instructions.

WHO MAY FILE:

A person who meets the qualifications specified in the Motor Fuel Tax Rules for Chapter 162 Motor Fuels Tax Law may file a

claim for refund of the state tax paid on gasoline or diesel fuel. (

)

WHEN TO FILE:

Claim for refund of fuels tax paid must be filed and postmarked ON OR BEFORE ONE YEAR from the FIRST DAY OF THE

CALENDAR MONTH following:

the purchase,

the tax exempt sale, and/or

the use if withdrawn from storage for own use.

FOR ASSISTANCE:

For assistance with any Texas Fuels Tax question please contact the Texas State Comptroller's office at (800) 252-1383 or

(512) 463-4600.

GENERAL INSTRUCTIONS:

Do not write in shaded areas.

TYPE or PRINT.

Complete all applicable items that are not preprinted.

If any preprinted information is incorrect, mark through it and write in the correct information.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

SPECIFIC INSTRUCTIONS:

Item c - Sole owner or individual - Enter your Social Security Number.

Corporation or other business - Enter your Federal Employer Identification Number (FEIN).

Item f - Begin date - Enter the date of the earliest invoice or the date of first withdrawal from bulk storage.

End date - Enter the date of the most recent invoice or the date of last withdrawal from bulk storage.

Item 1 - Check the appropriate box to show the exempt use of diesel fuel. Diesel fuel must be used on or after 9-1-2007.

Item 2 - Claim for gallons exported must be for 100 or more gallons.

Item 3 - Qualified passenger commercial motor vehicle refunds will be paid less 25% for the School Fund Benefit Fee (see Rule

3.1251).

Item 4 - Gasoline and diesel fuel must be purchased and used by the U.S. Government. Gasoline or diesel fuel used by third party

contractors is not eligible for refund.

Item 5 - Claims for gallons lost by fire, theft or accident must be for 100 gallons or more.

Item 7 - If you are claiming a gasoline refund on vehicles operated exclusively off-highway except for incidental travel (see Rule

3.443), you must attach the following information:

A. Total Miles Driven

B. (On-Road Miles) / (4 mpg) = (On-road Gallons)

C. (Total gallons) - (On-road Gallons) = (Refundable Gallons - Enter in Item 7)

Item 8 - If you are claiming gasoline used in power take-off (PTO) or auxiliary power units (see Rule 3.432), you must attach the

following information:

A. Indicate PTO type of unit (e.g., pump, cement haul truck, dump, etc.) and calculation:

(Total Gallons Delivered into Vehicle) x (5% fixed rate method) = (Refundable Gallons)

B. Indicate PTO type of unit (ready mix concrete and solid waste trucks only) and calculation:

(Total Gallons Delivered into Vehicle) x (30% fixed rate method) = (Refundable Gallons)

C. Indicate PTO type of unit (e.g., pump, cement haul truck, dump, etc.) and calculation:

(On-Road Miles) / (4 mpg) = (On-road Gallons

)

mileage factor method

(Total Gallons Delivered into Vehicle) - (On-road Gallons) = (Refundable Gallons)

D. Indicate PTO type of unit (e.g., pump, cement haul truck, dump, etc.) and direct meter method.

E. Indicate PTO type of unit (e.g., pump, cement haul truck, dump, etc.) and two tank method.

F. Alternative methods used - show calculation and attach copy of Comptroller Tax Policy approval letter.

G. Total PTO gallons claimed: add gallons from A, B, C, D, E and F, and enter on Item 8 under gasoline.

Item 9 - MTA providing public school transportation must provide documentation to support the claim (see Rule 3.448). Gallons

claimed for public school transportation must not be included with gallons claimed on Item 11.

Item 10 - Use for claims not covered by other items, such as licensed aviation fuel dealers.

Item 11 - MTA refund will be paid 1 cent per gallon of gasoline and 1/2 cent per gallon of diesel fuel (see Rule 3.431). Reduced rate

refund applies to qualified vehicles only. MTA must not include on Item 11 gallons claimed for public school transportation

on Item 9.

Item 12 - Check the appropriate box. Volunteer Fire Department refund effective July 1, 2009.

Please refer to the applicable tax rules for Chapter 162 Motor Fuels Tax Law for the correct method of determining the amount of your

refund claim and the documentation that you must have to support your claim.

(Do not file any of the documentation with this claim.)

Links to the appropriate statute are located at

.

1

1 2

2