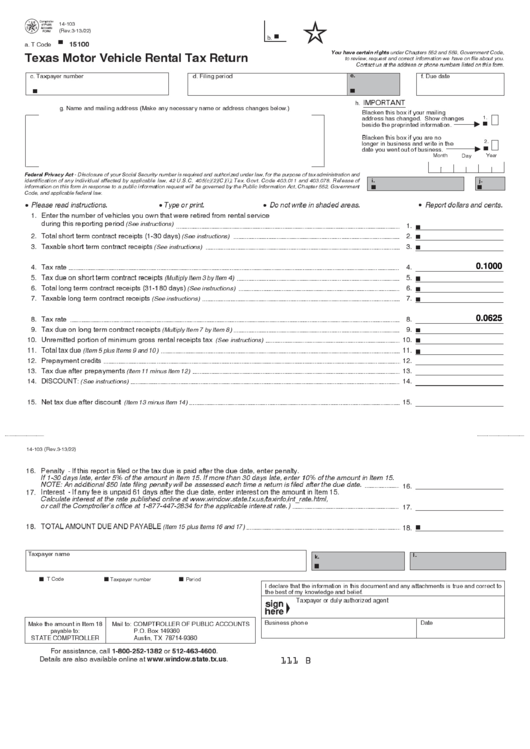

14-103

(Rev.3-13/22)

RESET FORM

PRINT FORM

b.

a. T Code

15100

You have certain rights

under Chapters 552 and 559, Government Code,

to review, request and correct information we have on file about you.

Texas Motor Vehicle Rental Tax Return

Contact us at the address or phone numbers listed on this form.

c. Taxpayer number

d. Filing period

f. Due date

e.

IMPORTANT

h.

g. Name and mailing address (Make any necessary name or address changes below.)

Blacken this box if your mailing

1.

address has changed. Show changes

beside the preprinted information.

Blacken this box if you are no

2.

longer in business and write in the

date you went out of business.

Month

Year

Day

Federal Privacy Act

- Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and

identification of any individual affected by applicable law, 42 U.S.C. ÿ 4 05(c)(2)(C)(i); Tex. Govt. Code ÿ ÿ 4 03.011 and 403.078. Release of

i.

j.

information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government

Code, and applicable federal law.

Please read instructions.

Type or print.

Do not write in shaded areas.

Report dollars and cents.

1.

Enter the number of vehicles you own that were retired from rental service

during this reporting period

(See instructions)

1.

2.

Total short term contract receipts (1-30 days)

2.

(See instructions)

3.

Taxable short term contract receipts

3.

(See instructions)

4.

Tax rate

4.

0.1000

5.

Tax due on short term contract receipts

5.

(Multiply Item 3 by Item 4)

6.

Total long term contract receipts (31-180 days)

6.

(See instructions)

7.

Taxable long term contract receipts

7.

(See instructions)

8.

Tax rate

8.

0.0625

9.

Tax due on long term contract receipts

9.

(Multiply Item 7 by Item 8)

10.

Unremitted portion of minimum gross rental receipts tax

10.

(See instructions)

11.

Total tax due

11.

(Item 5 plus Items 9 and 10)

12.

Prepayment credits

12.

13.

Tax due after prepayments

13.

(Item 11 minus Item 12)

14.

14.

DISCOUNT:

(See instructions)

Net tax due after discount

15.

15.

(Item 13 minus Item 14)

14-103 (Rev.3-13/22)

16. Penalty

If this report is filed or the tax due is paid after the due date, enter penalty.

-

If 1-30 days late, enter 5% of the amount in Item 15. If more than 30 days late, enter 10% of the amount in Item 15.

NOTE: An additional $50 late filing penalty will be assessed each time a return is filed after the due date.

16.

Interest - If any fee is unpaid 61 days after the due date, enter interest on the amount in Item 15.

17.

Calculate interest at the rate published online at ,

or call the Comptroller's office at 1-877-447-2834 for the applicable interest rate.)

17.

18. TOTAL AMOUNT DUE AND PAYABLE

(Item 15 plus Items 16 and 17)

18.

Taxpayer name

l.

k.

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct to

the best of my knowledge and belief.

Taxpayer or duly authorized agent

Business phone

Date

Make the amount in Item 18

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149360

STATE COMPTROLLER

Austin, TX 78714-9360

For assistance, call

or

.

1-800-252-1382

512-463-4600

111 B

Details are also available online at

.

1

1 2

2