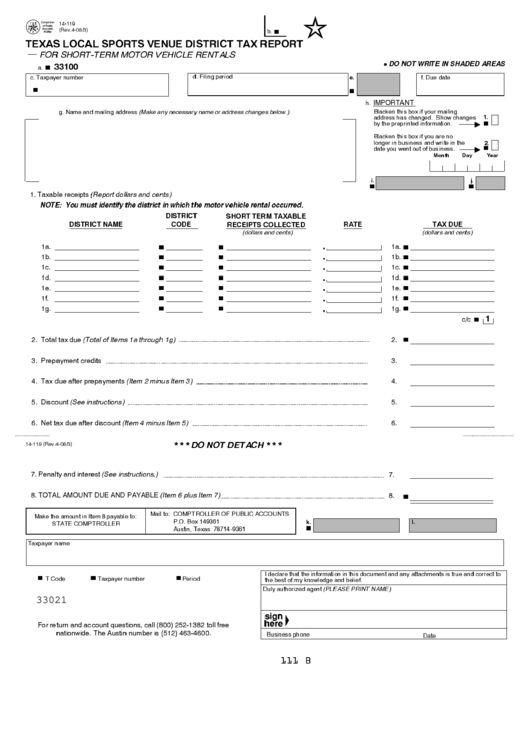

14-119

b.

(Rev.4-08/3)

TEXAS LOCAL SPORTS VENUE DISTRICT TAX REPORT

FOR SHORT-TERM MOTOR VEHICLE RENTALS

DO NOT WRITE IN SHADED AREAS

33100

a.

d. Filing period

c. Taxpayer number

f. Due date

e.

IMPORTANT

h.

Blacken this box if your mailing

g. Name and mailing address (Make any necessary name or address changes below.)

address has changed. Show changes

1.

by the preprinted information.

Blacken this box if you are no

longer in business and write in the

2.

date you went out of business.

Month

Day

Year

i.

j.

1. Taxable receipts (Report dollars and cents)

NOTE: You must identify the district in which the motor vehicle rental occurred.

DISTRICT

SHORT TERM TAXABLE

DISTRICT NAME

RATE

TAX DUE

CODE

RECEIPTS COLLECTED

(dollars and cents)

(dollars and cents)

1a.

.

1a.

1b.

1b.

.

1c.

.

1c.

1d.

1d.

.

1e.

.

1e.

1f.

1f.

.

1g.

1g.

.

c/c

1

2. Total tax due (Total of Items 1a through 1g)

2.

3. Prepayment credits

3.

4. Tax due after prepayments (Item 2 minus Item 3)

4.

5. Discount (See instructions)

5.

6. Net tax due after discount (Item 4 minus Item 5)

6.

* * * DO NOT DETACH * * *

14-119 (Rev.4-08/3)

7. Penalty and interest (See instructions.)

7.

8. TOTAL AMOUNT DUE AND PAYABLE (Item 6 plus Item 7)

8.

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

Make the amount in Item 8 payable to:

P.O. Box 149361

STATE COMPTROLLER

k.

l.

Austin, Texas 78714-9361

Taxpayer name

I declare that the information in this document and any attachments is true and correct to

T Code

Taxpayer number

Period

the best of my knowledge and belief.

Duly authorized agent (PLEASE PRINT NAME)

33021

For return and account questions, call (800) 252-1382 toll free

nationwide. The Austin number is (512) 463-4600.

Business phone

Date

111 B

1

1 2

2