Form 12-100 (Back)(Rev.11-12/22)

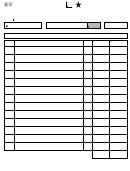

Instructions for Completing the

Texas Hotel Occupancy Tax Report

(TEX. TAX CODE ANN. ch. 156)

General Information

Who Must File:

You must file this report if you are a sole owner, partnership, corporation or other organization that owns, operates, manages or

controls any hotel or motel in Texas.

Complete and detailed records must be kept of all receipts reported and exemptions or reimbursements claimed so that reports

can be verified by a state auditor.

Failure to file this report and pay applicable tax may result in collection action as prescribed by Title 2 of the Tax Code.

When to File:

Reports must be filed on or before the 20th day of the month following the reporting period.

Reports must be filed for every period even if you have no amount subject to tax or no tax due.

If the due date falls on a Saturday, Sunday or legal state holiday, the next business day will be the due date.

For Assistance:

Call 1-800-252-1385 or 512-463-4600.

General Instructions:

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, mark it out and write in the correct information.

If any location shown is no longer in business, blacken the appropriate box in Item h.

Specific Instructions

Item c -

Enter your taxpayer number. If there has been a change in ownership, the new owner must apply for a new taxpayer number by completing a TEXAS HOTEL

OCCUPANCY TAX QUESTIONNAIRE (Form AP-102) for each business location.

Item d -

Enter filing period of this report, monthly or quarterly, and the last day of the period.

Items 1-3 - Enter the number of rooms, trade name, location address (including city, state and ZIP code) and location number assigned by the Comptroller for each location

reporting. If the number has not been assigned or is not known, leave blank. If information is preprinted, verify information and make any necessary corrections.

If you are reporting for a new location, enter the starting date of operation and number of rental rooms for the location.

NOTE: If additional space is needed to list all locations, complete the Texas Hotel Occupancy Tax Report Supplement, Form 12-101. Use as many supplement

reports as necessary.

Item 4 -

Enter the total amount of room receipts for the location shown. Enter"0" if no receipts were collected.

REMEMBER: Subtract the total amount of exceptions from the TOTAL RECEIPTS (Item 4) and enter the result in TAXABLE RECEIPTS (Item 5). If you have

no taxable receipts to report enter "0". DO NOT ENTER EXEMPTIONS/ DEDUCTIONS ON THIS REPORT.

Item 5 - Enter the amount of TAXABLE receipts for the location shown. Enter "0"

if no taxable receipts were collected.

NOTE: The following are exceptions to the tax:

use or possession of a room for at least 30 consecutive days as a

permanent residence with no interruption of payment for the period; or

use by religious, charitable or educational organizations where no

part of the net earnings benefit the organization (see Rule 3.161); or

use by a State of Texas official presenting a hotel tax exemption card.

(See Rule 3.161.) NOTE: State government agencies and their

employees (except those state employees with hotel tax photo ID

cards) may NOT claim an exemption for hotel tax.

Item 6 -

Enter the combined total of all total room receipts shown in Item 4 of this

Electronic reporting and payment options

report and all room receipts shown in Item 4 of all supplemental reports,

are available 24 hours a day, 7 days a week.

Form 12-101, for the reporting period. Enter "0" if no receipts were collected

Have this form available when you log on.

for this reporting period.

Item 7 -

Enter the combined total of all taxable room receipts shown in Item 5 of this

report and all taxable room receipts shown in Item 5 of all supplemental

reports, Form 12-101, for the reporting period. Enter "0" if no receipts were collected for this reporting period.

Item 9 -

Discount - If the report is filed and the tax paid on or before the due date, enter a discount of one percent (.01) of Item 8.

Item 11 - Penalty - If report is filed or tax paid after the due date, enter penalty. If 1-30 days late, enter 5% of Item 10. If more that 30 days late, enter 10% of Item 10

(Minimum penalty $1). NOTE: An additional $50 late filing penalty will be assessed each time a report is filed after the due date.

Item 12 - Interest - If any tax is unpaid 61 days after the due date, enter interest on the amount in Item 10. Calculate interest at the rate published online at

or call 1-877-447-2834 for the applicable interest rate.

1

1 2

2