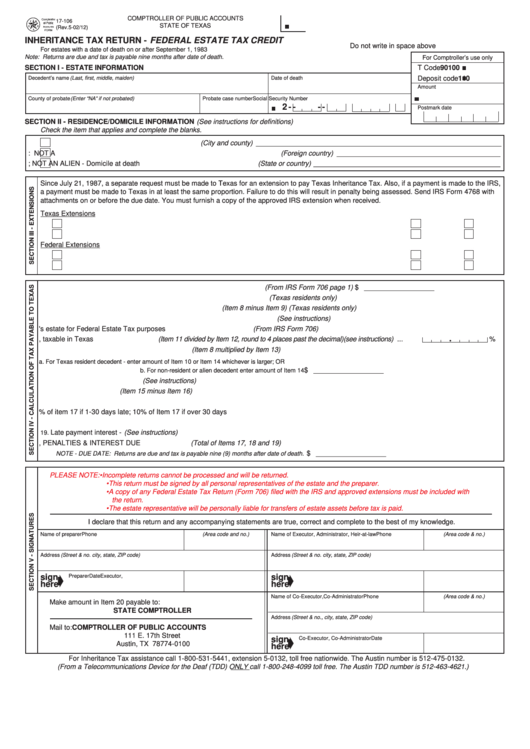

COMPTROLLER OF PUBLIC ACCOUNTS

17-106

STATE OF TEXAS

(Rev.5-02/12)

INHERITANCE TAX RETURN - FEDERAL ESTATE TAX CREDIT

Do not write in space above

For estates with a date of death on or after September 1, 1983

Note: Returns are due and tax is payable nine months after date of death.

For Comptroller’s use only

SECTION I - ESTATE INFORMATION

T Code

90100

Decedent’s name (Last, first, middle, maiden)

Date of death

Deposit code

110

Amount

County of probate (Enter “NA” if not probated)

Probate case number

Social Security Number

2 -

-

-

-

Postmark date

SECTION II - RESIDENCE/DOMICILE INFORMATION (See instructions for definitions)

Check the item that applies and complete the blanks.

TEXAS RESIDENT - Domicile at date of death (City and county) _______________________________________________________________

1.

ALIEN: NOT A U.S. CITIZEN OR RESIDENT - Domicile at date of death (Foreign country) __________________________________________

2.

NON RESIDENT OF TEXAS; NOT AN ALIEN - Domicile at death (State or country) ________________________________________________

3.

Since July 21, 1987, a separate request must be made to Texas for an extension to pay Texas Inheritance Tax. Also, if a payment is made to the IRS,

a payment must be made to Texas in at least the same proportion. Failure to do this will result in penalty being assessed. Send IRS Form 4768 with

attachments on or before the due date. You must furnish a copy of the approved IRS extension when received.

Texas Extensions

4.

An extension to file the Texas Inheritance Tax Return until _____________________________

has been

requested

granted

5.

An extension to pay the Texas Inheritance Tax until ___________________________________

has been

requested

granted

Federal Extensions

6.

An extension to file the Federal Estate Tax Return until ________________________________

has been

requested

granted

7.

An extension to pay the Federal Estate Tax until _____________________________________

has been

requested

granted

8. Total state death tax credit allowable for Federal Estate Tax purposes (From IRS Form 706 page 1) ......................... $ __________________

9. Amount paid to other states which is allowable as state death tax credit (Texas residents only) .................................

__________________

10. Amount of state death tax credit not paid to other states (Item 8 minus Item 9) (Texas residents only) .......................

__________________

11. Gross value for Federal Estate Tax purposes of property taxable in Texas (See instructions) .....................................

__________________

12. Gross value of decedent's estate for Federal Estate Tax purposes (From IRS Form 706) ...........................................

__________________

.

13. Percent of estate, taxable in Texas (Item 11 divided by Item 12, round to 4 places past the decimal)(see instructions) ...

%

14. Amount of credit for property taxable in Texas (Item 8 multiplied by Item 13) ..............................................................

__________________

15. TAX PAYABLE TO TEXAS -

a. For Texas resident decedent - enter amount of Item 10 or Item 14 whichever is larger; OR

.................................................. $ __________________

b. For non-resident or alien decedent enter amount of Item 14

16. Amount of tax previously paid (See instructions) ..........................................................................................................

__________________

17. Net amount of tax due (Item 15 minus Item 16) ............................................................................................................

__________________

18. Late payment penalty - 5% of item 17 if 1-30 days late; 10% of Item 17 if over 30 days late .......................................

__________________

Late payment interest - (See instructions) ....................................................................................................................

__________________

19.

20. TOTAL TAX, PENALTIES & INTEREST DUE (Total of Items 17, 18 and 19)

.................................................. $ __________________

NOTE - DUE DATE: Returns are due and tax is payable nine (9) months after date of death.

PLEASE NOTE: • Incomplete returns cannot be processed and will be returned.

• This return must be signed by all personal representatives of the estate and the preparer.

• A copy of any Federal Estate Tax Return (Form 706) filed with the IRS and approved extensions must be included with

the return.

• The estate representative will be personally liable for transfers of estate assets before tax is paid.

I declare that this return and any accompanying statements are true, correct and complete to the best of my knowledge.

Name of preparer

Phone (Area code and no.)

Name of Executor, Administrator, Heir-at-law

Phone (Area code & no.)

Address (Street & no. city, state, ZIP code)

Address (Street & no. city, state, ZIP code)

➧

➧

sign

Preparer

Date

sign

Executor, etc.

Date

here

here

Name of Co-Executor,Co-Administrator

Phone (Area code & no.)

Make amount in Item 20 payable to:

STATE COMPTROLLER

Address (Street & no., city, state, ZIP code)

Mail to:

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

➧

sign

Co-Executor, Co-Administrator

Date

Austin, TX 78774-0100

here

For Inheritance Tax assistance call 1-800-531-5441, extension 5-0132, toll free nationwide. The Austin number is 512-475-0132.

(From a Telecommunications Device for the Deaf (TDD) ONLY call 1-800-248-4099 toll free. The Austin TDD number is 512-463-4621.)

1

1 2

2