50-251

(Rev. 08-07/16)

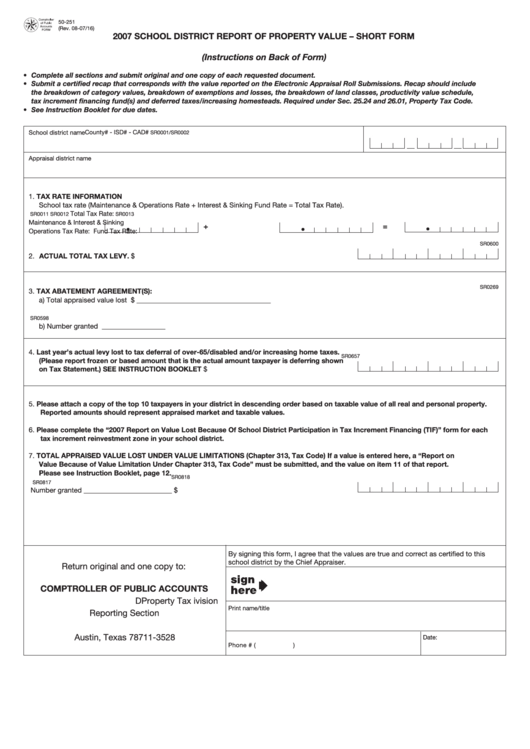

2007 SCHOOL DISTRICT REPORT OF PROPERTY VALUE – SHORT FORM

(Instructions on Back of Form)

• Complete all sections and submit original and one copy of each requested document.

• Submit a certified recap that corresponds with the value reported on the Electronic Appraisal Roll Submissions. Recap should include

the breakdown of category values, breakdown of exemptions and losses, the breakdown of land classes, productivity value schedule,

tax increment financing fund(s) and deferred taxes/increasing homesteads. Required under Sec. 25.24 and 26.01, Property Tax Code.

• See Instruction Booklet for due dates.

School district name

County# - ISd# - CAd#

SR0001/SR0002

Appraisal district name

1. TAX RATE INFORMATION

School tax rate (Maintenance & Operations Rate + Interest & Sinking Fund Rate = Total Tax Rate).

Total Tax Rate:

SR0011

SR0012

SR0013

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

SR0600

2. ACTUAL TOTAL TAX LEVY. .................................................................................................................. $

SR0269

3. TAX ABATEMENT AGREEMENT(S):

a) Total appraised value lost ................................................................................................................... $

______________________________________

SR0598

b) Number granted __________________

4. Last year’s actual levy lost to tax deferral of over-65/disabled and/or increasing home taxes.

SR0657

(Please report frozen or based amount that is the actual amount taxpayer is deferring shown

on Tax Statement.) SEE INSTRUCTION BOOKLET ............................................................................ $

5. Please attach a copy of the top 10 taxpayers in your district in descending order based on taxable value of all real and personal property.

Reported amounts should represent appraised market and taxable values.

6. Please complete the “2007 Report on Value Lost Because Of School District Participation in Tax Increment Financing (TIF)” form for each

tax increment reinvestment zone in your school district.

7. TOTAL APPRAISED VALUE LOST UNDER VALUE LIMITATIONS (Chapter 313, Tax Code) If a value is entered here, a “Report on

Value Because of Value Limitation Under Chapter 313, Tax Code” must be submitted, and the value on item 11 of that report.

Please see Instruction Booklet, page 12.

SR0818

SR0817

Number granted _________________________

$

By signing this form, I agree that the values are true and correct as certified to this

school district by the Chief Appraiser.

Return original and one copy to:

COMPTROLLER OF PUBLIC ACCOUNTS

Property Tax ivision

d

Print name/title

Reporting Section

P.O. Box 13528

Austin, Texas 78711-3528

date:

Phone # (

)

1

1 2

2